In collaboration with Section4…

Modern education is changing rapidly. COVID-19 accelerated pre-existing trends around remote collaboration, making it easier than ever to access world-class training from anywhere in the world.

At the forefront of this edtech explosion is Section4. Founded by NYU Stern Professor of Marketing Scott Galloway, Section4 brings some of the greatest business school professors and business leaders to teach two- to three-week intensive courses.

To us, Section4 stands out for a number of reasons:

- World-class professors: Every sprint is taught by a leader in their field, giving you a front-row seat to the most innovative ideas in business.

- Actionable education: The project you submit will apply directly to your own business, helping you take action immediately at work.

- Lifetime network: Connect with professionals from 60-plus countries and across industries to gain fresh perspective from like-minded leaders.

Scott Galloway is teaching their next Business Strategy Sprint. Learn more here.

If you only have a couple of minutes to spare, here's what investors, operators, and founders can learn about MetaMask.

- Crypto wallets are no longer niche. Three years ago, there were 31 million crypto wallet users; today, there are close to 80 million. While there’s a long way to go before web3 reaches its full potential, products like MetaMask are far from esoteric. It has 21 million users alone.

- MetaMask is a big business. In 2021, the company surpassed $200 million in revenue. That is thanks to its "Swaps" feature, which allows users to exchange their cryptocurrencies without leaving the product.

- Consumers have different expectations. Clients like MetaMask were built with developers in mind. That made sense given crypto's origins, but as less technical consumers start to dabble in web3, a higher premium is being placed on design.

- Building defensibility is tricky. Because crypto wallets pull data from the blockchain, there is no user lock-in. In a matter of minutes, a user can switch from one wallet provider to another with no loss of data. That means providers have to find other ways to build defensibility. Winning over developers is one.

- Competition is heating up. Right now, MetaMask is king. There are plenty of rivals gunning for the throne, though. Coinbase offers a wallet, and Block (fka Square) is likely to follow suit. Insurgents like Rainbow, Phantom, and Argent are not to be underestimated.

Disclaimer: I'd like to take a moment to remind readers that I am not a journalist. Rather, I am a writer and investment analyst. The Generalist exists to explore the future and the companies defining it. It is not an investigative news organization. As part of my process, I tell the stories of how great businesses began. In today’s piece, you’ll notice that this history is contested. I have done my best to be as thorough, objective, and even-handed as possible, presenting the facts as I learned them.

Bruce Wayne sits across a dinner table from Gotham city's dashing District Attorney, Harvey Dent. Flanked by unavailable love interest Rachel Dawes and his own glamorous date, Wayne listens as Dent warms into his speech. He is defending the vigilantism of Batman, not knowing that the man behind the mask is sitting in front of him.

"When their enemies were at the gates, the Romans would suspend democracy and appoint one man to protect the city. And it wasn't considered an honor. It was considered a public service."

"Harvey, the last man that they appointed to protect the Republic, was named Caesar, and he never gave up his power," Dawes counters.

"Ok, fine...You either die a hero or live long enough to see yourself become the villain."

This scene outlines the perspective of Christopher Nolan's 2008 film, The Dark Knight. The distance between admiration and enmity, heroism and villainy, is a hairline fracture — the difference, simply a matter of time.

It's also an apt framing for MetaMask. Though far and away the most widely-used wallet in the crypto space, responsible for onboarding tens of millions of users to the world of web3, a clunky product has left many of the sector's most ardent adherents exasperated.

The result is a paradoxical company capable of provoking wildly different perspectives. Supporters will point to MetaMask's admirable ubiquity and jaw-dropping $200-plus-million in 2021 revenue as an indication that MetaMask is just getting started. Meanwhile, skeptics prepare their eulogies, seeing the company as web3's Yahoo, waiting to be eclipsed by Google.

As in Nolan's film, the difference between those positions is neither as inscrutable nor as intractable as you might think.

In today's piece, we'll parse MetaMask's place in the crypto landscape, outlining its provenance, functionality, and importance. We'll also unpack its obvious flaws, think through potential next moves, and enumerate those beginning to challenge for the throne. In particular, you'll hear about the following:

- Origins. MetaMask's history can be traced back to the first-ever Ethereum Devcon. It is also a contested tale.

- ConsenSys. The parent company behind MetaMask has gone through multiple evolutions.

- Product. Though robust architecturally, MetaMask's front-end experience can be bewildering to newcomers.

- Traction. This has proven an explosive year for MetaMask. It's generating hundreds of millions in revenue, with close to a 100% margin.

- Future. We are in the very early stages of the crypto revolution. Wallets like MetaMask will have to adapt to technological and social changes.

Prehistory: Vapor

Miami

It was an unlikely location for what would prove a momentous meeting. Better known for its spring-breakers and silver-haired snow-birds, Florida has not always been known for technological innovation. When it comes to the story of Ethereum, the Sunshine State may deserve more credit.

In January of 2014, a rather rag-tag group met at a beach house in Miami. While they'd chosen the state so that they might attend the North American Bitcoin Conference held at the Clevelander Hotel on South Beach, the real purpose of their visit was to discuss a different crypto project: Ethereum.

Months earlier, the coltish Vitalik Buterin, just 19 at the time, had written its "whitepaper" outlining the possibilities he saw for a "computer in the sky." His work had attracted support and attention, including from those that joined him in Miami. He was joined at the beach house by two other devilishly talented developers: the scruffy, intense Gavin Wood and the bespectacled Charles Hoskinson. Businessmen Anthony Di Iorio and Joseph Lubin were also part of the discussions.

If Buterin exercised an effortless gravitational pull of those convened, Lubin must have seemed most out of orbit. The Torontonian had thirty years on Buterin and was in attendance after having been invited along by Di Iorio. While Lubin's background as an engineer meant he quickly grasped the consequence of what was being discussed, his age and stature meant he read more like a Wall Street suit than software subversive.

As it happened, Lubin had worked on Wall Street. After graduating from Princeton with a degree in electrical engineering and computer science — where he roomed with future crypto investor Michael Novogratz — Lubin had spent seven years as a research scientist before joining Goldman Sachs as a Vice President.

Anyone who thought Lubin was an uncreative financial type would have misunderstood him, though. Several other interludes illustrated a non-conformist bent. After college, Lubin had tried to make it as a professional squash player; in the aftermath of the 2008 crisis, he considered going full Colonel Kurtz, mulling over the purchase of an obscure tract of land in Peru that could serve as a post-apocalypse bolthole. In the end, he started a dancehall record label after being romanced by a Jamaican singer.

All of which is to say that Lubin might have seemed like the "grownup in the room," but his history demonstrated an adventurousness and open-mindedness that would have surprised anyone quick to judge him.

During the group's stay in Miami, Lubin not only secured his presence at the vanguard of the Ethereum revolution but established himself as the commercially-minded counterbalance to Buterin's cerebral and emotional core. It would prove a defining moment in Lubin's career and the history of Ethereum.

Devcon 0

Eleven months later, many of the same characters would find themselves across the Atlantic Ocean at another conference. Devcon 0, Ethereum's first official forum, was held in Berlin and featured talks from Buterin, Wood, and a cadre of other early believers.

By that point, the Ethereum team had made a core decision: it would be a non-profit endeavor. Led by Buterin, that choice had fractured the leadership team and sent some of that first group to seek new pastures. Though still close to Buterin, Lubin was among those that began to look beyond the project and toward more commercial avenues. Around the time of Devcon 0, he had started a new venture: ConsenSys. The firm was designed to fund and found businesses built on Ethereum, aiding in the network's adoption and bringing its benefits to the swathes of uninitiated consumers and enterprises.

In a conference room in Berlin, the precursor to one of ConsenSys' star properties was born.

Joel Dietz was a zealot among a sea of the converted. Boasting the kind of floppy hair that made Hugh Grant a nineties star and a boyish face, Dietz had already established a certain presence in the ecosystem. Not only did he muse on the future of cryptocurrency in Bitcoin Magazine, he'd started a series of meetups for Ethereum enthusiasts in Silicon Valley.

In addition to those activities, Dietz was working on a project of his own — or rather, a number of them. In our exchange, Dietz described himself, saying, "I've always been a busy guy with multiple projects."

One of those projects was Swarm, a bitcoin-based crowdfunding platform. He was also apparently working on a series of crypto browser extensions. As it turned out, that positioned Dietz to act on one of the ideas that circulated during the conference. Here's how he recalled it:

There was a lot of talk at Devcon 0 about a need for a JavaScript client and some web3 interface that bridged between the standard web app world and the Ethereum client world.

In one of the conference's side rooms, Dietz sat down with Buterin and Wood and made a simple pitch: he should receive one of the recently announced Ethereum Developer Grants and create a JavaScript-based crypto browser.

Buterin did not seem to take much convincing. As recalled by Dietz, he warmed to the idea, even suggesting a name for it: Vapor. Though no funding was committed, Dietz left Berlin with yet another project.

Back in California, he set to work leveraging the network he'd built. He wanted to talk to "every JavaScript developer that had done any sort of presentation on Ethereum clients" in the state. In the end, it must not have taken too long — by Dietz's recollection, no more than four such presentations had been made. Among those was a group of Apple employees, led by "JavaScript hacker" Aaron Davis.

With a sweep of orange-blonde hair that would later part into dreadlocks, Davis was best-known in the crypto world by his pseudonym, "Kumavis." Like Dietz, he'd been early to recognize the potential in the blockchain and had started experimenting by building. In our exchange, Kumavis mentioned that he'd come up with the idea for an Ethereum wallet after planning a crowdfunding campaign and realizing he needed a way to "disseminate links" to it.

Dietz and Kumavis decided to team up to build Vapor — on an informal basis at first. A third member, Martin Becze, who had been living in a coworking house Dietz helped run and aiding the Ethereum Foundation, also hopped aboard.

To raise funding, the trio tried to gain access to the place that has powered so many unicorns: Y Combinator.

In an application video available on YouTube, you can see Becze, Dietz, and Kumavis explain what, exactly, they are trying to build.

Though brimming with enthusiasm, it is not the crispest pitch. But how would you describe what it was they were building without the established language we now have? The word "wallet" is not mentioned once in the one-minute clip because it carried none of the connotations it does today. Instead, the team describes what they're building as marrying "the browser with the blockchain."

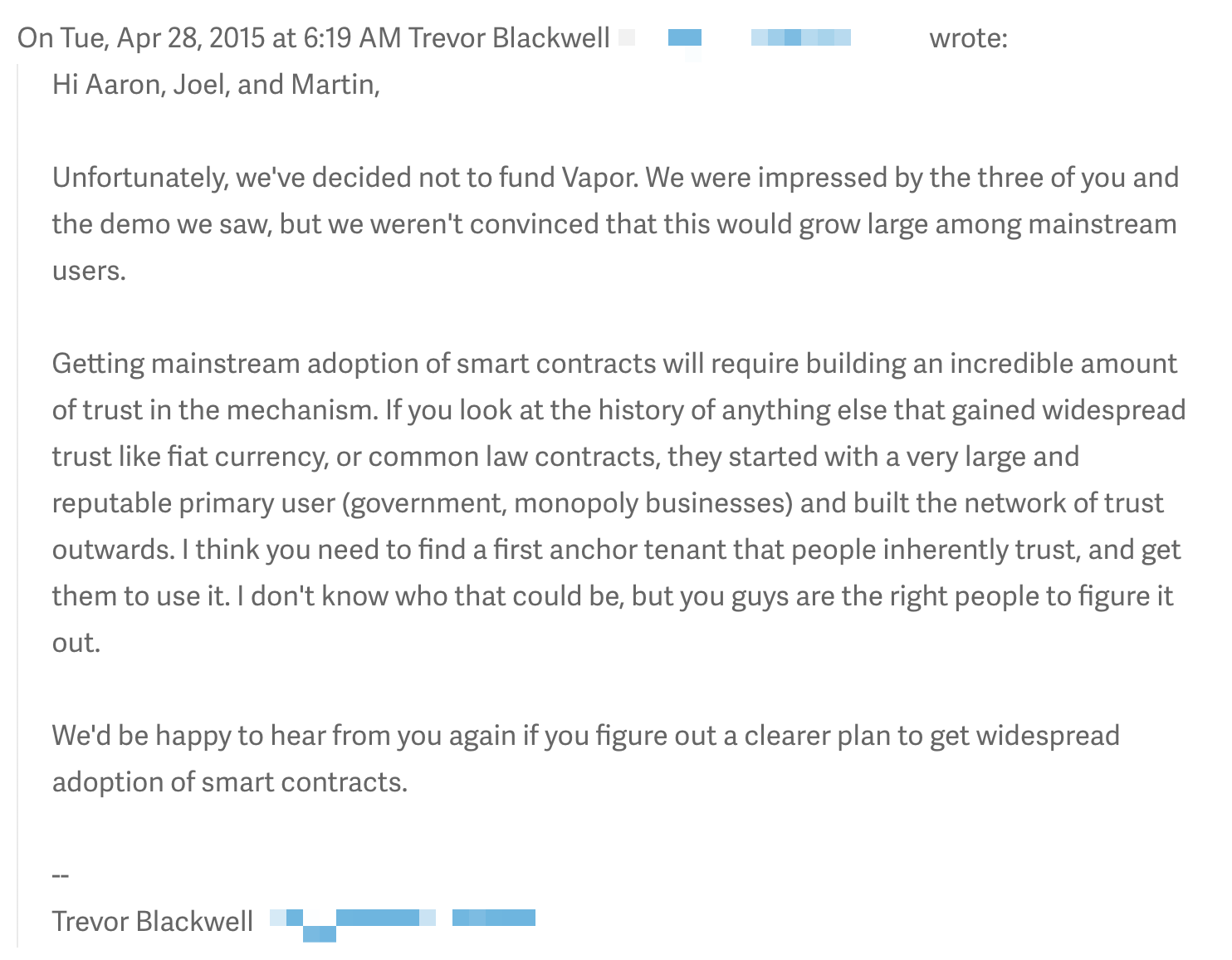

To Y Combinator's credit, that pitch sparked enough curiosity to extend an invitation for an interview, but rejection followed. Dietz provided the email that the team received, sent by YC partner Trevor Blackwell. It's a wonderful artifact from the early days of web3:

With the benefit of hindsight, it is tempting to dunk on YC — Ha! How do you like our smart contract adoption now?! — but Blackwell's position was one held by the majority of technologists, even those adept at predicting and funding the future.

Even without the firepower of YC, Vapor's founders continued working on the project. But cracks began to show.

Post-YC: Tricky territory

Up to this point, the Vapor story tracks with reasonable clarity. But it is about to fall down a rabbit hole and into shadow. We will make it out the other side but must first try and wade through a murkier narrative.

In researching this piece, I attempted to speak with each of Vapor's three founders, contributors to MetaMask's success, and others in the wallet space. Though I was able to hear from many, there are missing pieces. I did not get to speak with Joe Lubin nor Martin Becze. Daniel Finlay, a ConsenSys developer considered one of MetaMask's founders, responded after this piece was first published. The piece was updated to include his account.

That means that this next segment primarily relies on the testimony of two of Vapor's founders, Joel Dietz and Kumavis. They differ.

After the YC rejection, Kumavis continued to work on building Vapor. He quickly found that he was the only one of the trio to contribute. Becze was focused on other Ethereum-related engagements, while Dietz was ostensibly engaged with other projects. "I did 100% of the work," Kumavis noted.

Dietz himself seemed to confirm Kumavis was the primary contributor, independently remarking that he "did about 90% of the work specific to the coding." For his part, Dietz initially noted that he had "financed the early development," referencing paying for office space and team meals. Kumavis was explicit that Dietz "never paid for anything," challenging him to provide receipts.

When asked for more detail on what his funding entailed, Dietz specified that he paid for sushi lunches and dinners, which was the "only direct financing" he provided. Regarding office space, Dietz directed me to this TechCrunch video, which highlights his role as "papa" of the Love Nest, a hacker house in Palo Alto. He noted that Becze lived at the Love Nest, with his rent paid for by the Ethereum Foundation. Dietz's inference, though not entirely clear, seemed to be that because work related to Vapor occurred in the Love Nest, he indirectly subsidized its development. Dietz agrees that any benefit from working at the Love Nest was not received by Kumavis, saying, "[he] hadn't left his day job yet, so he never really worked out of our office."

Then comes the issue of the Ethereum Foundation's grant. At Devcon 0, Dietz had apparently spoken to Buterin and Wood about receiving funding for Vapor. Once back in California, he set to work on penning the application for a $30,000 grant. By his recollection, Dietz wrote 60-70% of the grant, with the rest added by Becze. A version of that document can be downloaded here, on a site ostensibly hosted by Dietz. Dietz was unable to confirm whether the document is the final version received by the Ethereum Foundation or an earlier draft.

Though not included in the grant document — perhaps an indication it is not the final copy — both Dietz and Kumavis mentioned a provision that would have granted Dietz payment. Specifically, Dietz stated that he was supposed to receive 10% of the grant's $30,000 for his contribution to the Vapor project.

To Dietz, this seemed like fair recompense for the dinners he had paid for, as well as his time spent writing the grant. In a message, he noted that $3,000 was "about the amount of expenses I had incurred for the project." He clarified the figure included the cost of his flights to Devcon 0 before Vapor had been formed. By his estimate, those sushi dinners had cost him perhaps $700.

This read as a reason for concern for Kumavis. He didn't understand why a portion of the grant would be used to pay out one of its contributors. Of Dietz, he said, "he had a plan to take a chunk of the money for himself, and not as a salary. It didn't make any sense." Kumavis referenced a message from Dietz — which I did not review — which stated he expected 15% of the grant rather than 10%.

Was this grant ever paid out?

Again, the matter is contested; it may be something that only the Ethereum Foundation can officially untangle. Dietz says yes. His basis for this claim seems to be that Kumavis later received a grant from the Foundation to work on an Ethereum wallet. His implication is that Kumavis received the reward for work put in by him and Becze in writing the grant.

Part of the reason Dietz seems to suspect subterfuge is because he was surprised by Kumavis' departure from the project. As he tells it, he found himself removed from Vapor's Github organization and Slack channel, the former which was renamed "Metamask." The experience left him feeling as if he'd been unfairly pushed out the door, saying, "I guess you could say I was forced out."

To Kumavis, the separation was much less dramatic and contentious. He did remove Dietz from Vapor's Github and Slack, but that's because Vapor wasn't going anywhere. Frustrated by his co-founders' lack of effort, as well as feeling the product "wasn't quite right," he decided to cut ties and start afresh. Indeed, by his recollection, Vapor was a "browser in browser" rather than a browser extension. MetaMask is famously the latter. He applied for a new grant from the Ethereum Foundation separately. It was this submission that later was awarded, meaning the funds received were at his discretion. I have not seen a version of this second grant application.

Kumavis used the $30,000 to support his work in building a new project from scratch: MetaMask. After the money ran out, he continued working alone for a period, but with no salary and a newborn, he decided to take the project to ConsenSys. At that time, it was just a "scrappy crew of hackers," which felt like a good fit.

After joining, Kumavis looked to bolster the new project's firepower. To do so, he turned to Dan Finlay, a friend, and former colleague from Apple. Finlay's impact seems to have been immediate and memorable. As Kumavis tells it, as a surprise, Finlay brought a fox logo for the project to use— today, it is MetaMask's calling card. Emphasizing the freshness of this endeavor and its lack of reliance on Vapor's code, Kumavis said, "Since we just started from scratch, we had the fox before any working features."

For his part, Finlay agrees with Kumavis' story. In a follow-up email, he shared the following statement:

Joel [Dietz] did work briefly on grant proposals for a different abandoned Ethereum wallet project called Vapor, which was a browser within a browser — not a web extension. MetaMask is not based on Vapor, and has never shared any code with Vapor. That was before the MetaMask project was born. At no point did Joel work on what became MetaMask. Furthermore, despite his claims, Joel is also not a founder of Ethereum, either.

(As a note, Dietz did not claim to be a founder of Ethereum in our interactions.)

We can emerge, now, on the other side and back in the balmy sunshine of uncontested truth. Vapor died. And MetaMask emerged under the banner of ConsenSys, with its future defined by Kumavis, Dan Finlay, and Joe Lubin.

Don't miss our next briefing. Our work is designed to help you understand the most important trends shaping the future, and to capitalize on change. Join 55,000 others today.

History: The Many Faces of ConsenSys

To understand what MetaMask became, we need a clearer picture of its adopted-parent company. ConsenSys does not make such depiction easy, however. Over the course of its seven years, it has changed approaches several times, adapting to shifting market dynamics as well as operational upheaval.

Head Economist at ConsenSys, Lex Sokolin, explained the company's various phases, picking out three distinct shifts. We'll examine how these different changes influenced MetaMask's development.

Phase 1: Crypto Burning Man

The ConsenSys that Kumavis joined sought to be something like a startup laboratory, bringing brilliant technologists together and giving them the financial support and free reign to build what the crypto ecosystem needed.

While noble in spirit, that created an environment with little structure. As Sokolin noted, Lubin funded a hundred companies in hundreds of different ways during this period, and "some of the ways were pretty loose."

Mike Demarais, co-founder of Rainbow, another crypto wallet provider, captured this aspect of ConsenSys colorfully, "[It's] kind of a crazy place. It's kind of like Burning Man with a salary." Demarais has watched the company closely and hired many that spent time under its auspices.

This both suited and hamstrung MetaMask.

On the one hand, it allowed Kumavis and Finlay to keep pushing the project forward. Initially, the team had thought MetaMask would be a much simpler project and quicker to build. Sokolin said, "It became the never-ending project. In a good way." Had there been a stricter deadline or end-state, MetaMask might not have become as robust.

Conversely, ConsenSys' looseness meant the project had little vision. Though Kumavis and Finlay were extremely talented, they saw MetaMask as a developer tool, not a consumer project. Brandon Millman, CEO of Phantom wallet, partnered with the MetaMask team during his previous work at 0x, an API provider. He highlighted this clear preference and the logic behind it:

It was clear that the product was being built by developers for other developers. This makes a ton of sense, as most users of Ethereum were developers in the early days.

But while focusing on developers might have made sense in 2014 — and has lasting benefits — the absence of a longer-term plan for consumer usage hampered MetaMask. Today, many of the complaints stem from the product's lack of intuitiveness. Many of those decisions seem to have been baked in from the start.

Phase 2: Slash and survive

After an exuberant 2017, crypto slumped into a two-year winter. Bitcoin, which had been trading at the heady price of $19,000, plummeted to nearly $3,000; Ethereum fell from almost $1,400 to $84.

Inevitably, ConsenSys was badly hit. Not only had its holdings collapsed in value, but faith in the entire crypto endeavor had withered. More than ever, it became popular for an ostensibly learned sort of person to proclaim they saw great potential in the blockchain, but not in crypto.

ConsenSys pivoted to serve exactly this kind of pseudo-skeptic. Rather than watering the dozens of startups struggling to blossom under its absent-minded care, it focused on equipping large institutions with the knowledge and service to explore the blockchain revolution. Banks, media companies, and governments all relied on ConsenSys' consulting services over the following years. Sokolin remarked that the firm had been engaged by ten central banks to advise digital currency projects.

ConsenSys wasn't a picture of financial health, however. In late 2018, the firm fired 13% of staff to put itself on better financial footing. That MetaMask survived this period was a sign that it had already established itself as a core piece of infrastructure. The same year that those cuts occurred, MetaMask surpassed 1 million downloads — not bad for a project passed over by Y Combinator just a few years earlier.

Phase 3: Split and streamline

Starting in 2020, ConsenSys began to restructure itself. Struggling to raise financing, the company split itself into two separate entities: "ConsenSys Mesh" and "ConsenSys Software." Each had its own focus.

ConsenSys Mesh would serve as an investing entity, overlooking a portfolio of businesses and financing new companies.

"ConsenSys Software" would bundle the company's leading technological assets into a more legible offering. Sitting under this new banner was Infura, Truffle, Codefi, Diligence, and, of course, MetaMask. This quintet would be joined by Quorum in August of 2020 after ConsenSys purchased the business blockchain platform from JP Morgan.

To facilitate the change, the company once again made cuts, letting 14% of its workforce go. As a strategic maneuver, at least, it seemed to pay off. ConsenSys Software announced a $65 million funding round in April of 2021, followed by a $200 million top-up in November.

While surely aided by the white-hot cryptocurrency markets, backing from blue-chip financiers like Third Point and Marshall Wace was also a show of faith in ConsenSys's new structure.

For MetaMask, the rearrangement brings a kind of logic.

For one thing, ConsenSys seems keen to promote real synergies between its six different properties — a benefit that remained tantalizingly theoretical while it governed over its software salmagundi. With fewer products to focus on, it should be able to construct true bridges.

Just as critically, it should finally get more funding. Not only is ConsenSys doing a better job of raising, but it no longer needs to divide incoming capital amongst a slew of offerings. As the clear star of the portfolio, alongside the development platform, Infura, MetaMask will be a real priority.

Such clarity has arrived not a moment too soon. MetaMask's traction hit overdrive in 2021, making it one of the most popular blockchain applications in the world. ConsenSys needs to prove it is a suitable steward.

A Definition: What maketh a crypto wallet?

Before we further examine MetaMask's prospects, it's worth taking a moment to more concretely define what a crypto wallet does and what users can expect from it.

Parsing web3 primitives is often tricky, and single analogies rarely capture the full picture. With that in mind, let's use five analogies to unpack crypto wallets. By the end, we'll have a grasp of their functionality, position in the ecosystem, and importance.

- Wallets are like...a wallet.

- Wallets are like...a bank account.

- Wallets are like...a passport.

- Wallets are like...a browser.

- Wallets are like...a magical inventory.

Wallets are like wallets

This one's easy. Crypto wallets earned their name because they do function like regular wallets. They're designed to secure your money and make it available for spending. Just like you might pull out a trusty billfold at your local coffee shop, you would log into your MetaMask when you're ready to buy an NFT on OpenSea.

Wallets are like bank accounts (or fintech apps)

That's not the full picture, though, for two major reasons.

- Crypto wallets don't actually custody your assets.

- Crypto wallets can do a lot more than physical ones.

Let's walk through these.

Firstly, while a traditional pocketbook quite literally holds your money — a wrinkled $10 stuffed beside a Metrocard — crypto wallets don't. Your bitcoin or Ethereum is not truly stored on MetaMask. Instead, those assets live on the blockchain. Your crypto wallet simply manages a "private key," essentially a secret passcode that gives anyone who wields it the power to manage funds.

In that respect, it's not so different from a bank account. When you launch the JP Morgan Chase app, type in your password, and look at your balance, you're not literally observing the money itself but a representation of it presented digitally.

The analogy works even more cleanly if you were to open something like Personal Capital, which displays your entire portfolio but is not responsible for the custody of it. The relationship between crypto wallets and crypto-assets is at a similar removal.

Secondly, you're able to engage in more varied activities from a bank than you can from a physical wallet. Physical wallets allow the user to operate effectively two commands: add and subtract. You can put money in (add) or take money out (subtract).

Crypto wallets are different and more similar to a bank account in this way. Beyond adding or subtracting funds, you can use your crypto wallet to earn interest through staking, issue loans, pay a friend, or undertake any manner of different maneuvers. While these are not executed in the wallet, it is the mediator that facilitates these relationships to form.

Just as you might use your Chase account to get a mortgage, you might use your MetaMask account to take out a crypto loan.

Wallets are passports

Web3 is a kind of online parallel universe. It requires an understanding of different terminology, different cultural norms, and different money. While you could participate in parts of the crypto economy without a wallet like MetaMask, it is necessary to engage in many of the realm's attractions.

To use a decentralized exchange like Sushi, for example, you need to have a wallet with which to interact. So too, if you want to take advantage of the absurd and perhaps unsustainable interest being offered by Olympus. Buying an NFT on OpenSea certainly requires one, as does playing the world's most popular crypto game, Axie Infinity.

Companies like MetaMask provide this access, bringing your identity along for the ride. While you can surf the decentralized web anonymously (or pseudonymously), you can also attach signifying information like an NFT or Ethereum name that marks out who you are.

Wallets are a passport, representing a sense of identity and opening a new world.

Wallets are browsers

Because of their utility in manipulating assets, wallets are often the place crypto activities begin. For example, if I wanted to trade Ethereum for Luna, I could do so through MetaMask. Similarly, if I wanted to send money to a friend, I'd probably start with a wallet rather than Coinbase.

That gives wallets a position of power. Like a web browser, crypto wallets mediate our experience and interactions with the blockchain, sitting between us and the action we want to undertake.

Wallets are magical inventories

One of my favorite abstractions comes from Sokolin. As he described, wallets are a "magical inventory." That's because they contain a lot more than just currency, displaying your financial, social, and artistic assets and relationships.

For example, in my wallet, you can find…

- Some cryptocurrency. Mostly Ethereum, which functions as the closest equivalent to fiat currency. I use it to buy other currencies and NFTs or pay gas fees incurred by using the Ethereum network.

- An Ethereum domain. I bought mariog.eth via Ethereum Name Services, a provider of crypto domain names. This functions as an on-chain identity.

- A few visual NFTs. I own a Philosophical Fox, of course, along with a couple of other NFTs.

- A token The Generalist created. Earlier this year, we minted the GENERALIST token as part of an experiment in crowdfunding, multiplayer media, and NFTs.

- Some tokens from a DAO. As part of my research into DAOs, I joined a few. I own tokens that signify membership and governance power.

This is a pretty dizzying medley that shows just how much more powerful crypto wallets are from their real-world equivalents.

To better understand how this combination comes together, let us turn to MetaMask's product.

Product: Functional but flawed

Though best known for its consumer service, MetaMask has two other stakeholders: developers and institutions.

Consumers

More than 21 million people use MetaMask. The vast majority are consumers. For these users, MetaMask fulfills four core functions:

- Management. Users can see the tokens they're holding and manage their private keys.

- Transfers. MetaMask provides an interface for users to send tokens to others or move them within one's own account.

- Purchases. Users can use their MetaMask wallet to buy tokens or NFTs.

- Swaps. A more recent addition, MetaMask lets customers remotely swap tokens via other exchanges. It's proven to be a huge revenue generator.

- Signing. Through MetaMask, you can verify different transactions, like joining a DAO or minting an NFT. This is done by "signing," a shorthand for verification.

MetaMask extends this functionality in two forms: a browser extension and a mobile app. The latter is a much more recent addition, released in autumn of 2020. Both are fairly barebone experiences that ask a great deal of the user.

Let's take a tour of the experience.

To begin, this is what MetaMask looks like in the browser. The fox icon sits in the corner, and once logged in, users can access a miniature portal that shows their balance and offers quick access to three key functions: Buy, Send, Swap.

A fuller view provides a little further information, showing the rest of one's balance.

Users that press "Buy" prompt a modal to open, which links to different crypto on-ramps and offers direct depositing.

Pressing "Send" pushes you to this fairly inscrutable screen that can be used to move tokens between your accounts or send them to another party.

On that subject, you can see your different accounts within MetaMask by hitting the profile avatar in the top-right corner. By doing so, you also surface the ability to add additional accounts, import accounts, or connect a hardware wallet. These are small, USB-sized devices that serve the same purpose as something like MetaMask but live offline and are thus less likely to be penetrated. (You can, of course, still lose them.)

Hitting "Swap" brings up MetaMask's quasi-exchange feature. In exchange for a fee, the wallet searches for a place to swap one currency for another for the best price possible. For example, via Swaps, you could trade your ETH for SUSHI, setting a "slippage tolerance" for how much price variability you're willing to stomach. As alluded to, this little feature is a phenomenal money-spinner.

Finally, when it comes time to validate some kind of transaction on-chain, MetaMask springs into action. For example, when you navigate to OpenSea and attempt to purchase an NFT, MetaMask pops up, asking you to "sign" and confirm the action.

Though functional and admirably restrained, MetaMask does not feel like an easy product, nor a fully-featured one. Navigating between accounts feels vaguely perilous, and though MetaMask tries to simplify transactions, the clutter of crypto-jargon, maximums, timing estimates and gas information is bewildering for even the intermediate user. Though it has access to the relevant data, nowhere can a user see the NFTs they've bought — other services offer much fuller functionality.

Though seven years in the making, MetaMask still feels a very long way from the seamless 1-click checkouts of Amazon.

It's important to note that this is just one aspect of MetaMask's product. While its front-end may be flawed, MetaMask's back-end is exceptional. The company has put serious work into its architecture and taken great pains to make the most secure product possible. That craft has made MetaMask a developer favorite.

Developers

MetaMask's confusing consumer experience may be beside the point. More than we may realize, MetaMask is a developer-first product.

Lex Sokolin highlighted this focus. While he noted that the team's number one priority is on improving the core product and bolstering security, he noted that "the second thing the team prioritizes is developers."

As he described it, MetaMask exists in large part to give crypto developers an interface through which to access consumers. The thinking is that a virtuous flywheel can form: as more developers use MetaMask, the product becomes more valuable, attracting more consumers, which lures in the next wave of developers.

So far, this plan has played out extremely well. MetaMask boasts integration to more than 17,000 destinations across the crypto realm.

To make itself attractive to builders, MetaMask has composed accessible documentation that makes it easy to leverage the product. This is a real point of separation from others in the space — even Coinbase, for all its wealth, does not offer equivalent clarity. Francesco Agosti, CTO of Phantom, mentioned how effective MetaMask had been here:

I think they've also always been good about building in the open and implementing their developer APIs as standards instead of proprietary interfaces. I also see they've taken security very seriously and have made many of the tools they use for security open source, which I appreciate.

Insurgents, which we'll discuss shortly, may succeed in providing smoother user experiences, but none seem to be as honed in on developers.

Institutions

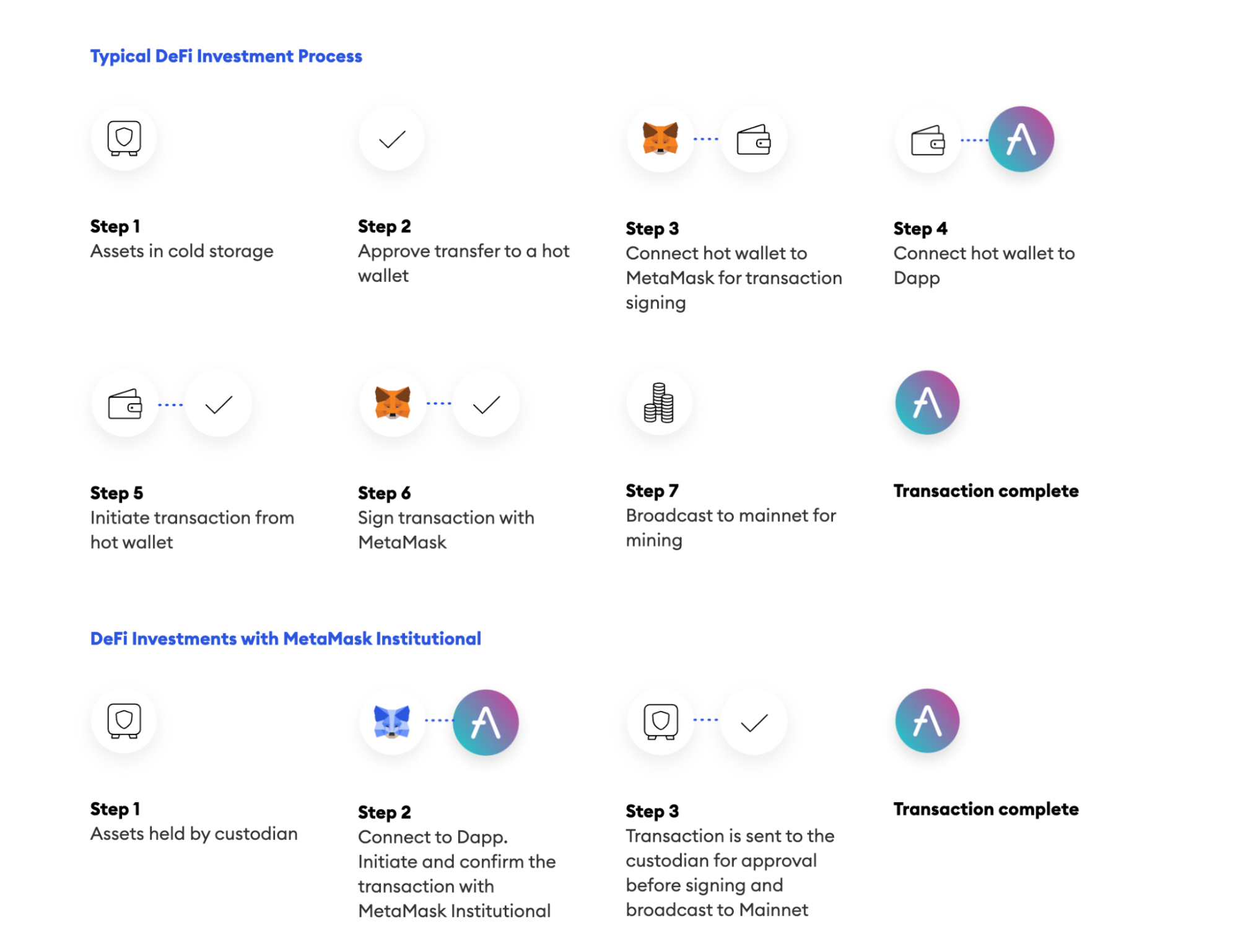

Earlier this year, MetaMask announced its next big move: powering institutional clients, including funds, market makers, and traders. While the core interface looks similar to marketing materials, behind the scenes, MetaMask has added security, custody, and transactional features.

On the security side, MetaMask seems to be leveraging one of its ConsenSys siblings, Codefi. While ConsenSys has been criticized in the past for creating too many siloed products that hardly speak to each other, in this case, they appear to be working in tandem, with Codefi's "Trusted and Automated Compliance" powering MetaMask Institutional (MMI).

Custody-wise, MetaMask is partnered with providers BitGo, Cactus, and Qredo -- it will surely need to add other big players to beef up its offering.

Finally, MetaMask's Institutional marketing site notes that a streamlined transaction process will simplify operations and save on gas fees.

Taken together, it appears to be a strong first foray into serving larger businesses and one that leans on MetaMasks' strengths. For all of its time spent soul-searching, ConsenSys has built a strong reputation and network among large institutions; it should be able to leverage these relationships to MMI's benefit.

Traction: MetaMask Goes Supersonic

Weaknesses in MetaMask's product should be accompanied by appropriate context. Though the team has had time on its side, it has never had the most salubrious of workplace structures beneath it. Moreover, in the past year, MetaMask has undergone the kind of scale-snapping growth that would break a lesser service.

In a little over a year, MetaMask's monthly active users grew by 2,100%, from 1 million to more than 21 million. While undoubtedly positive news, it's hard to imagine how much pressure that has put on MetaMask's system and the people that maintain it.

In commenting on MetaMask's deficiencies, Sokolin remarked with an exhausted, exasperated smile, "People should be nice about it. It's an unbelievable amount of stress on the team."

MetaMask's surge is not simply about usage — the company has also scaled revenue rapidly. In October of 2020, the team unveiled the "Swaps" feature outlined above. As mentioned, Swaps allow users to exchange their currencies, with MetaMask executing the transaction on a separate exchange. As payment for doing so, MetaMask extracts a 0.875% fee.

It's proven to be an extremely sharp move. Despite charging a fee that some consider "exorbitant," MetaMask has succeeded in monetizing Swaps extremely effectively. Research firm Delphi Digital reported that MetaMask's revenue through the feature hit $200 million in 2021. By comparison, DeFi favorites like Sushi made just $70 million over the same period.

Delphi ends its analysis of MetaMask's revenue provocatively:

Now consider this: Metamask's customer acquisition cost (CAC) is a big, fat zero. Metamask has no token incentives or emissions, so there's virtually no cost to their revenue. Their profit margins are close to 100%. Imagine if they had a token.

Such a suggestion isn't out of left-field. MetaMask has flirted with launching a token several times in its history. Most recently, Joe Lubin tweeted a suggestion of $MASK:

Would tokenizing make sense for MetaMask?

It doesn't seem like a slam dunk. For one thing, MetaMask hasn't publicly articulated an explicit idea of what functionality a token would serve. Past discussions have apparently mentioned such a token allowing customers to upvote potential new features, called a "token-weighted backlog." According to Demarais, that's the "weakest claim to value" for such a project to wield.

Furthermore, there's the risk that a token simply adds short-term heat to a project. In our discussion of OpenSea, we outlined how Rarible's $RARI token briefly gave them a dominant position in the NFT market — but it didn't last. Tokenless, OpenSea overtook them with a robust, focused product better-suited to consumer demands. Demarais noted, "Having a token doesn't make you win. It can boost you."

After 18 months of rocketing forward on jet fuel, MetaMask looks less like a company in need of a jolt and more like one requiring a reset. Phantom CEO Millman said of a potential $MASK token:

I'm personally a bit skeptical. What MetaMask needs to do right now is focus on improving their core offering. Bringing the broader "community" into some token governance process will only serve to slow down development and iteration speed. I think everyone can agree that we need many more cycles to get wallet products right.

Overall, MetaMask deserves great credit for surviving the hyper-drive of 2021 and effectively monetizing it. To keep its leading position, though, it will need to adapt to new challenges.

Learn what matters in tech and crypto – for free. Every Sunday, we send you a free email unpacking one of the most important companies in tech and crypto. You’ll understand how they work, why they matter, and what it means for you.

Future: Where do wallets go?

There is no sector moving more rapidly than cryptocurrency. It changes meaningfully on a daily basis with new companies, technologies, and financiers constantly emerging. We are in the first minute of the first inning, and there are many more wild days ahead than behind us.

That means that crypto wallets are, by definition, incipient. They are not-even-half-formed things, made to serve use-cases that will change, powered by technologies that may be usurped. Such volatility presents risk as well as opportunity.

We can expect four evolutions in the web3 space that directly impact wallets:

- There will be greater competition.

- There will be greater adoption.

- There may be increased demand across networks.

- There will be greater use cases.

Each will influence MetaMask's future. We'll unpack these and think through how well the market's current leader is positioned.

Greater competition

When MetaMask officially launched in 2016, it had the benefit of being in an extremely sparse field of competitors. In the years that followed, others entered the fray, but none succeeded in toppling MetaMask as the space's most used service.

That may not be the case forever. Competitors are arising from multiple angles, with established players tacking on wallet services and insurgents looking to exploit MetaMask's vulnerabilities.

Coinbase is the most obvious player from the first category. The cryptocurrency exchange also offers a wallet product that boasts a similar design to its core product. Coinbase Wallet offers support for NFTs and connects to the main exchange, simplifying the process of trading.

For Coinbase to win in the wallet space, it may need to take a more neutral approach. To perform Swaps, MetaMask searches across different exchanges to find the best price for the user. Would Coinbase be willing to act as a fair broken if given the same task, or will it inevitably favor its native exchange? CEO Brian Armstrong noted in an exchange with The Generalist that it would be "very shortsighted" for his company's wallet to give preference to other Coinbase products.

Block, the Jack Dorsey company known as Square until this week, could face a similar issue. Though Block does not yet offer a wallet, it is rumored to be working on one in the bitcoin space, under the auspices of sub-brand, Spiral. While seemingly obsessed with bitcoin above all other challengers, it's possible Spiral or a similar entity may make its way to the Ethereum-focused world dominated by MetaMask. Again, while a potentially useful on-ramp, true users may eventually chafe against any default-power Block gave to its crypto exchange services.

Decentralized exchanges and other crypto projects are also making plays in the space. According to Demarais from Rainbow, both Uniswap and Aave are likely to come out with mobile wallets. From his perspective, at least, these organizations will succumb to the same problem — using the wallet as a way to bolster a different business unit rather than a truly distinct entity.

That leaves the many upstarts, of which Rainbow is among the most prominent. To Demarais and his team, the playbook is simple: make a wallet that a normal consumer could use and provide both the education and support that a new experience merits.

Phantom takes a similar approach but leverages a different wedge. Rather than starting by supporting the Ethereum ecosystem, Millman and Agosti decided to capitalize on the insurgence of Solana.

Today, Phantom is the go-to for Solana users, an approach that's clearly paying off. Recent figures from the team state that Phantom has 1.5 million monthly active users and is seeing 100,000 new installations per week. It has raised $9 million with funding from Garry Tan and a16z.

Argent is another prominent player, with $16.2 million banked from leading firms like Paradigm, Hummingbird, and Index. Focused on the Ethereum ecosystem, Argent makes it easy to access 20% APYs through DeFi protocols like Aaave and Compound. According to one source, Argent shines from a technical perspective with strong safety features and robust architecture.

There are other players that would merit greater discussion in a different piece. Trust, Pillar, Dharma, Frame, Balance, Torus, WalletConnect (an SDK), and many more play meaningful roles in the ecosystem. Alongside those are several unannounced projects already creating buzz.

If ever there was a space growing fast enough to accommodate multiple winners, it is crypto. But though that dynamic means MetaMask won't fret too much about competition, the endemic nature of the blockchain makes switching to a new provider much simpler than it does in other industries. Because all of the data is stored on-chain, users can fairly effortlessly swap one wallet for another without loss of context. This "wholesale ejecting," as Demarais calls it, is a win for consumers but reduces defensibility for players in the space. That's exacerbated by the fact that since many projects are open-source, they can be forked and recreated.

In sum, the crypto space's dynamics make it likely that MetaMask will face many competitors and a consumer base prone to promiscuous usage.

Greater adoption

A large part of the reason MetaMask will face so many rivals is because crypto is entering the mainstream, bringing with it a wave of new users, including consumers, institutions, and developers.

Let's look at consumers first. Three years ago, there were an estimated 31 million crypto wallet users; today, there are nearly 80 million.

Such figures still pale in comparison to the adoption of other technologies. In 2018, the World Bank estimated that 3.8 billion had access to a traditional bank — while there are currently 4.6 billion active internet users. Will we eventually see crypto wallets achieve similar penetration?

Whether it hits such heights, players in the space will need to appeal to a broad audience. MetaMask does have an advantage in this respect: name recognition. While its product is not perfect, it is the default provider. Demarais said as much, noting, "It's become the verb. It's become the brand. That's our challenge."

In an attempt to unseat MetaMask, Rainbow was counter-positioned aggressively. While MetaMask feels wonkish and esoteric, Rainbow has the bounce and color of a social media challenger. That's allied with a consumer-friendly voice and inclusive ethos. On the subject of consumer adoption, Rainbow's community lead, Jackson Dame, said:

The future of Web3 and the onboarding of the next 100 million users will require much more user-friendly and intuitive experiences. I don't think many in the ecosystem would describe MetaMask using those words.

It may not be too late for MetaMask to catch up. The company should have plenty of dry powder it can use to hire talented designers; if it can convince them, they will have the latitude to do their best work. Part of the challenge may be that MetaMask is so ingrained in its ways, so established as a developer product that a true revamp is not possible.

According to Demarais, "MetaMask is not going to be the app on my little brother's home screen." Kumavis, Finlay, and Lubin will hope he's wrong.

As noted, MetaMask seems much better positioned when it comes to institutions. The company's long history is likely to play well. Of its move to serve institutional clients, Demarais said, "I think that it's very smart...The fact [MetaMask] hasn't changed in five years is almost a conservative, good thing [for institutions]."

The product's historical focus on developers should also come in handy. While products like WalletConnect make it easier for app developers to offer integration with many different wallets at once, MetaMask is often the first port-of-call when it comes to adding such capabilities. While the current team doesn't seem particularly well-equipped to undergo a consumer revolution, Kumavis and Finlay are among the best in the world at knowing what tooling developers might want next.

Even Demarais is bullish on MetaMask's potential here, noting, "I'm a believer in Metamask as a developer tool."

Phantom's Agosti thinks it is not enough to simply win over one constituency, though. In a discussion on defensibility in the space, this was his take:

Wallets do have virtuous cycles and network effects of sorts. Developers integrate with popular wallets, and developers build applications that attract users, making the wallets more popular. In an indirect way, developer adoption has been the main driver of growth for wallets like Metamask. Users don't download Metamask to use Metamask; they download Metamask because they want to farm or buy an NFT.

Whoever is able to win the hearts and minds of both users and developers will benefit the most from this virtuous cycle.

More networks

A year ago, Solana was trading for $1.80. At the time of writing, it is priced at just beneath $200. Such an electrifying rise is just one indication of the prominence the project has risen to in a short amount of time. In the years to come, we may see many others repeat something like Solana's trajectory, which is to say that it feels as if we are heading towards a multi-chain, multi-networked future. We may choose Ethereum for one kind of interaction, Bitcoin for another, Solana for a third, and Terra for a fourth, for example.

Such proliferation has implications for MetaMask and other wallet makers. The right move is not clear. Should these companies embrace a multi-network reality and expand their offering? Or is it better to double-down and specialize, building a rich feature set for one network?

Adding new chains is a great deal of work. Sokolin said, "It's very, very hard to add a new chain." Not only does it add technical complexity, but it increases the potential for user confusion. Having to swap between different networks based on the transaction type requires some degree of knowledge, and that education will take time.

But if users are constantly swapping between different chains, lacking such functionality could be meaningful. Francesco Agosti adeptly summarizes the quandary:

If there are several chains with comparable market share (# of users, # of transactions), and these chains serve similar types of applications, then I believe that a multi-chain wallet is a better experience. If there is a significant difference between how the chains work, or the user-base of the chains, or the use-cases those chains provide...then the answer is not as clear. A multi-chain wallet will struggle to compete with a wallet that specializes in a particular niche, on a particular chain.

For now, MetaMask supports Ethereum and its ecosystem. For the time being, it doesn't need to do much else. But should project's like Solana and Terra continue to prosper, it may need to expand its purview.

More uses

The concept of a general-purpose wallet may slowly fade into obsolescence. As more exchanges and interactions occur on-chain, products may specialize in serving them. Already, there are certain wallets that are winning over certain niches.

Jackson Dame highlighted how Gnosis Safe has become the "de-facto choice for almost every DAO looking to self-custody assets." The product's multi-signature functionality makes it particularly well-suited for DAO's communal financial structure.

We can see a similar trend emerging in gaming. Already, there are wallets that profess to explicitly serve the space, with Wombat as one example. Its bonuses for playing blockchain games and rich NFT support have attracted close to 1 million users.

In time, there may be many such sub-sectors to serve. Agosti once again encapsulates this potential well:

There will probably be a handful of massive waves of crypto use-cases that expand the total addressable market for wallets by an order of magnitude over the next 5 years... The winners will be those that benefit the most from those waves or create the waves themselves.

MetaMask should not be expected to catch all of these, but it will want to ensure it is not so leaden-footed as to be washed ashore. So far, the company has not been the most agile or rapid of shippers.

By the end of The Dark Knight, Gotham is in shambles. Driven mad by the death of Rachel Dawes, Harvey Dent, the virtuous District Attorney, embarks on a murderous rampage, only stopped when the cloaked Bruce Wayne sends him plummeting to his demise. To protect the city from the psychological damage of having the upstanding Dent unmasked as a killer, Wayne hatches a plan with Gotham's Police Commissioner Gordon. Batman will take the fall, receiving the blame for Dent's crimes. And Gotham will sleep better, believing that morality, that goodness, is not quite so fluid.

The film ends with Commissioner Gordon speaking to his son. When his son asks why Batman is running when he hasn't done anything wrong, Gordon explains, "Because he's the hero Gotham deserves, but not the one it needs right now."

MetaMask is a crypto hero. For more than six years, its team has worked to build a product that may not be beautiful, but that works. A vital primitive that can be depended upon and trusted. By doing so, MetaMask has opened web3 to tens of millions of users and thousands of developers. Demarais described the company's contribution succinctly: "None of us would be here without MetaMask."

Such a pivotal contribution is worthy of respect and reward. But it does not mean that the eddies of popular opinion will be kind to MetaMask. As more consumers flood into the space, they will expect a level of polish and design that, right now, the front-end does not have. Until this gap is truly addressed, complaints of one kind or another will continue.

MetaMask may not mind. It has withstood plenty of tests already, enduring changes in its parent company's structure and the brutal vagaries of the crypto markets. As Commissioner Gordon says of Batman's exile, "He can take it." If any company can endure being unpopular while still being useful, it is MetaMask. It may not be loved, but it can take it.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Join over 55,000 curious minds.

Join 100,000+ readers and get powerful business analysis delivered straight to your inbox.

No spam. No noise. Unsubscribe any time.