In collaboration with Masterworks

In the aftermath of the pandemic, many of the wealthiest investors in the world are choosing to add to an under-the-radar asset class: art.

Take the Founder of Amazon, he spent $70 million on two paintings alone last year.

Why? Works are commonly selling for 15 times their asking price, prompting the WSJ to describe the art market as among the “hottest on Earth” right now.

Even if you’re not a billionaire, you can still invest in art.

I’m building my very own art portfolio with Masterworks.io, NYC’s newest unicorn which makes multimillion-dollar paintings as investable as stocks like TSLA or AMZN.

Masterworks is how regular people like us can invest in this exciting, alternative asset class.

I’ve invested in a number of their offerings, including a recent Pablo Picasso. If you’d like to join me, you can use my Generalist link to skip the waitlist*

If you only have a couple of minutes to spare, here's what investors, operators, and founders can learn about Terra.

- Terra is using crypto to build practical products. Unlike some other projects, Terra is grounded in the real world. It is used by millions of people to pay for everyday items, without the need for those users to interact with the blockchain or realize they're interacting with crypto.

- Its TAM is enormous. Terra can be understood as a "Layer 1" protocol with a fleet of stablecoins. The latter are cryptocurrencies designed to maintain a fixed price. This combination gives Terra the potential to serve as foundational infrastructure and eat into the payments market. So far, it's made progress on both fronts.

- Skeptics point to the project's stablecoin as a critical risk. Terra's stablecoin "UST" is not collateralized. Instead, its value is maintained through algorithms. Some have argued that stablecoins of this kind are "built to fail."

- Others argue we're at an inflection point. A recent update to Terra's infrastructure lays the groundwork for an explosion of new projects. We could see a flurry of additions add functionality and attract more capital.

Editor's note: this piece was written in November 2021, six months before Terra's subsequent meltdown. We have kept it up to show our thinking at the time, the view of the broader market, and the narrative Terra advanced. We reflected on crypto's fallout, rampant fraud, and obsession with speculation in "The Casino and the Genie." Though that piece focuses on the FTX collapse, its also serves as an unofficial coda to our Terra story.

__

"It's the biggest TAM in crypto."

Early in my research, I asked one expert what people most frequently miss when digging into Terra. What do they overlook?

This was his response.

This expert is not prone to exaggeration, and he is, as the designation suggests, extremely well-versed on the subject. At the time, I did not fully grasp his rationale for that position, but after hours of research, discussions with Terra's leadership, and conversations with many other crypto connoisseurs, I have come to.

Terra is building better money. Not only that, it is creating infrastructure for others to ceaselessly improve and remix it, giving it new abilities and uses. It is a blockchain and a bank and a payment processor, and a sort of technological nation-state. Terra's contributors are just as likely to compare it to Y Combinator as they are to Singapore.

And yet, while Terra has the potential to revolutionize the financial industry and mainstream crypto adoption, some believe it is destined to fail, architected for collapse.

In today's piece, we'll study Terra from different angles, touching on both its strengths and vulnerabilities. You'll hear about:

- Terra's origins. The founder of a mesh network startup and a successful e-commerce entrepreneur team-up.

- How it achieved wide adoption. Millions of South Korean consumers use Terra to buy products online or at their local stores. Many may not realize they're interacting with the blockchain.

- How Terra's UST stablecoin works. Can you create a stable currency that is backed by nothing? Terra believes so.

- Its growing ecosystem. An abundance of projects is being built on Terra, bringing new lending, trading, and social capabilities.

- The magic of Do Kwon. Founder Do Kwon has been compared to one of the greatest entrepreneurs of all time.

- The risk of collapse. "Algorithmic stablecoins" like Terra's have failed in the past. Could that happen here?

- A powerful community. Terra's "Lunatics" have played a pivotal role in the project's success.

By the end, you'll understand just why someone considers Terra to have the largest TAM in crypto.

Terra, forming

No entrepreneurial success can ever be attributed to a single person. Too many forks and inflections, favors and lucky breaks occur for that to be true. If you have to condense Terra's story to just two animating figures, however, you cannot look beyond its two founders: Do Kwon and Daniel Shin. They are the project's yin and yang, Terra's very own earth and moon.

Do Kwon and the quest for decentralization

Drive two and a half hours out of Seoul, and you'll find it: Everland. Every year, nearly 6 million visit South Korea's most popular theme park, making the journey to explore its various "zones." A guest might spend an hour in Everland's "American Adventure" neighborhood, listening to 1950s music and riding the "Rodeo," before heading over to "Magic Land" and its looming Ferris Wheel. In the afternoon, a traveler might choose to inspect the animals at "Zootopia," feeding a rabbit, riding a pony, watching a depressed polar bear paddle in tepid water.

Everland is an unlikely venue for one of the crypto world's most consequential founders' early successes — as if before Ethereum, Vitalik Buterin triumphed at Epcot.

Still, Do Kwon must have been pleased at the time. Just a few years after receiving his Computer Science degree from Stanford, Kwon had not only started a business but secured a major operation like Everland as a client.

That he was running a startup at such a young age would have been little surprise to those that knew him. He is, by all accounts, an intensely driven person and seems to have been for quite some time. By Kwon's estimation, he was an extremely ambitious student with a willingness to work long hours. After graduation, he was disappointed to find that ferocity lacking at Microsoft, his first employer. In our conversation, he recalled being stunned to discover that on his team of 40 engineers, just four were doing what he considered "real work."

Bored and restless, Kwon decided to work on something worthy of his efforts — he would have to build it himself. The result was Anyfi.

The company's mission was lofty: "Connect the world for free." For Kwon, that meant giving anyone in the world access to the internet and telecommunications networks for free. Any sought to make that happen through "mesh networking," using the power of the crowd to bootstrap a peer-to-peer service.

By installing Anyfi's software, users could relay bandwidth to those without access, serving as a new node within the network. For example, if you were in the range of wifi and had Anyfi set up, your phone could extend the range of that signal, unlocking access for those out of range. It was, in effect, a truly decentralized internet.

It was quite a novel idea, especially in 2016 when Kwon founded the business. His approach attracted interest: $1 million in grants from the South Korean government, angel funding, and early customers. Everland was among them, wooed by the potential to provide better wifi to its many park-goers.

In time, perhaps Anyfi might have been a success in its own right. But now, it feels significant only because of what it precipitated. As he sought to build the world's greatest mesh networking service, Kwon began learning about blockchain. After all, many of the concepts he was applying through his startup connected to the budding crypto industry. As he investigated topics like "decentralization" and "peer-to-peer networks," Kwon serendipitously began to fall down the rabbit hole. Soon, he was diving deep into the worlds of Bitcoin and Ethereum.

Kwon shifted focus. In 2017, along with college friend Nicholas Platias, he began to actively study the space, watching as the ICO boom blazed to life. Many seemed to be building applications on top of existing "currency" projects like Bitcoin, even though Bitcoin itself hardly functioned as a reliable medium of exchange. Maybe there was space to create a project that worked as an actual currency?

Inspired by the sector's potential and sensing a gap, Kwon and Platias started writing a whitepaper, spelling out some of the ideas they had. In particular, the pair were interested in the creation of a decentralized financial system that was actually usable by the average person — one in which a stable currency could be easily held and used as a form of payment both on and offline. In many respects, it was a return to the ideologies of Satoshi Nakamoto, at a time when Bitcoin's stomach-churning volatility had revealed that it was far from an ideal "peer-to-peer version of electronic cash."

As they explored this concept, Kwon and Platias lived frugally, eating ramen and working from Seoul's Airbnbs. When availability expired on one home, the duo moved on to the next.

Perhaps this period of home-hopping experimentation would have manifested into something tangible in time. But it was in meeting Daniel Shin that Kwon and Platias's early notions began to become tantalizingly real.

The commercial instincts of Daniel Shin

While Kwon was at the beginning of his entrepreneurial journey, to many, it might have looked as if Shin's had ended. In 2010, the Wharton graduate started Ticket Monster (TMON), one of South Korea's first e-commerce platforms, even beating Coupang to market. To finance the business, Shin raised $11 million from firms like Insight Venture Partners and Greenspring Associates.

TMON's offering, inspired by companies like Groupon and LivingSocial, found instant product-market fit in South Korea. In less than a year, Shin succeeded in reaching annualized revenue of $288 million, powered by TMON's popular "flash sale" mechanism. LivingSocial took notice. Roughly 18 months after founding the company, Shin sold TMON to the US business. Two years later, in 2013, when LivingSocial retreated from Korea, TMON was sold yet again to Groupon. That time, the price was disclosed: $260 million.

Shin was a young man with money and time. For a few years, he advised and incubated internet businesses in Korea and Southeast Asia — but it was in meeting Kwon that he found a true second act.

Though separated by nearly a decade, Kwon and Shin got on quickly, finding overlapping interests and developing a rapport. Shin was interested in Kwon's work — though he had yet to spend any meaningful time in the cryptocurrency sector, his experience building TMON had given him a front-row seat to online payments processing and its various quirks and failings.

In Kwon's theories about a better, decentralized monetary system, he saw not only a provocative idea but a solution to a tangible problem. What if instead of using decrepit, rent-seeking payment processors to manage transactions, online retailers could leverage a well-engineered, decentralized solution?

Kwon hadn't really considered commercializing his incipient invention. As explained, "I hadn't really thought of it [the project] like building a corporate organization. The initial intention was just to write a protocol...and see what happens."

The practical framing posed by Shin would come to shape Terra's very identity. Gabe, a semi-pseudonymous "Lunatic" — the name given to Terra's fans — explained:

The Terra blockchain developed based on the principle that the blockchain itself was a means to many ends, and for that means to succeed it had to be better compared to other options…[T]he founding team saw that there were several finance system pain points such as slow payment clearance and high payment fees. Following that, blockchain development happened to be the best available option to resolve those issues.

A partnership was born, and Shin set to work leveraging his contacts. As Kwon explained in our conversation, the TMON founder's Rolodex allowed the budding blockchain project to condense a product-discovery journey that might have taken months or years into weeks. He also brought a different type of thinking to the project. While Kwon noted that he "used to be a very theoretical and abstract type of person," Shin was "a more practical, numbers-driven executor."

Along with Platias and other early contributors, Kwon and Shin started to more concretely scope out their solution, receiving feedback from Korea's e-commerce players. They called it Terra.

Thanks to Shin's profile, the Terra team was quick to attract financing. By late summer of 2018, it attracted a $32 million investment from leading cryptocurrency exchanges, including Binance, OKEx, and Huobi. Other backers included TechCrunch founder Michael Arrington, Polychain Capital, and Hashed.

In the fundraising announcement for that round, Shin outlined an audacious vision: to "build a platform that competes with Alipay on the blockchain." The comparison to the Chinese super-app neatly encapsulated the team's desire to build an intuitive, widely used financial product that served both consumers and merchants. It also expressed the desire for secondary apps to be built on top of Terra's framework.

Even at that early stage, the project had succeeded in demonstrating that such an audacious vision was not just talk. At the time of that announcement, Terra had already signed up fifteen serious e-commerce players, including Woowa Brothers, Pomelo, and Tiki. These first clients were processing $25 billion a year — volume that Terra could potentially take a share of.

Baek Kim, an investor in that first round via Hashed, noted that this kind of traction made Terra particularly compelling, despite the project raising at a time when the crypto market had flatlined.

Regardless of its timing, Terra was off to the races. With millions in funding and an impressive list of investors, it was time for the team to put its expertise to the test. Surely neither Kwon nor Shin could have envisioned the journey that lay ahead.

UST: A "more useful dollar"

There is only so far we can go without a better understanding of what Terra is and how it works. Yes, it is a cryptocurrency project. Yes, it improves payment processing for e-commerce companies. Yes, it is — in some sense — creating "better money."

But what does any of that mean? Answering this question is not trivial. Terra's complexity on the back-end allows it to be compelling and intuitive to the user. It is somehow elegantly convoluted but entirely logical — a kind of financial watch with hundreds of gears working together to keep time.

In this section, we'll start with the most fundamental piece of Terra's feat of engineering: its stablecoin. First, though, we must begin with a more fundamental question.

What is money for?

It was, of course, the ancient Babylonians that first —

Don't worry. We're not going to do that here. We know that money, as a concept, is an old one and has existed in many different forms. Let's hone in on what it is we need our currency to do for us.

While the financial engineers among us will be able to think of many more esoteric cases, we can focus on the basics. We need our money to be useful in the following respects:

- As a method of payment. Money is a medium of exchange. We need it to work as a way to purchase goods and services and to receive payments in turn.

- As an interest-generating asset. When we have excess funds, we need a safe place to hold them that generates a return.

- As a way to invest. To increase our wealth, we need ways to invest in different asset classes. To do so, we may need to use our existing wealth as collateral.

Fundamentally, Terra is focused on solving these problems. It is a project that seeks to use blockchain's novel technology to solve practical, fundamental societal needs. To make that happen, Terra has set about creating its own money.

The point of stablecoins

It's hard enough to make money. But it's much, much harder to create money from scratch. Terra's whole system is founded on the latter — the fabrication of currency and a surrounding financial system.

Now, creating a cryptocurrency that functions as a medium of exchange has historically been rather difficult. Though the initial premise of Bitcoin was to create a true digital cash alternative, the asset's volatility has made it an ineffective payment method. Who wants to buy something with a currency that might increase in value by 20% in 24 hours?

You can imagine a scenario in which you buy a TV for 0.01724 BTC when the asset's price is $58,000 per token. That means you've paid about $1,000 for your next flatscreen. Ten minutes later, Bitcoin's price hits $60,000, meaning you effectively paid $1,034 for it now. When Bitcoin hits $69,000 two days later, your TV spend hits $1,190.

This kind of turbulence is typical among crypto assets, which is why a set of projects have emerged that seek not to increase their value but remain as stable as possible. Rather than moving around minute-to-minute, these "stablecoins" trace the price of a fiat currency as closely as possible. Usually, they peg themselves to USD.

Stablecoins serve an extremely important purpose within the crypto ecosystem. Not only do they open up crypto as a medium of exchange, but they provide a place for investors to park assets during volatility without needing to move into fiat. For example, if you're a long-time investor in Bitcoin but worry about short-term upheaval, you could choose to transfer some of those holdings into a stablecoin rather than selling and converting back into USD. While those holdings wouldn't benefit from an upswing in Bitcoin's price, they're protected from a drop. (At least, in theory.)

The decentralized finance (DeFi) movement has also been a huge beneficiary of stablecoins. Without some stability in terms of value, many fewer would have been willing to stake their holdings in exchange for interest.

Clearly, stablecoins have value. But how exactly do they maintain their stability? How is it that a token can continually be worth $1?

The answer is, it depends. Though there are many variations, the best way to quickly delineate between stablecoin projects is to determine whether they are centralized or decentralized and to what extent they are collateralized by an external asset. Rather than these being binary categorizations, most projects exist on a spectrum.

A quick explanation:

- Centralized versus decentralized. Centralized stablecoin projects may be able to act more quickly, with less consensus needed. However, they present an easier target for regulators, given there is a clear operating body that can be acted upon. Though managing a decentralized stablecoin may be more difficult, it is much harder for external bodies to administer.

- Collateralized versus algorithmic. Collateralized stablecoins benefit from security. Presuming the project is trustworthy, users know that their money is safe and can be redeemed at any time. This is particularly true if the stablecoin is backed 1:1 by robust "off-chain" assets like the US dollar. The downside is that a huge amount of capital is required for these projects to scale — before you can increase the supply of tokens, you must accumulate reserve assets. By removing or reducing reserve requirements, stablecoin providers can scale more quickly. Some projects do away with the concept of collateral altogether. Though these "algorithmic" approaches are more capital-efficient, they may also be riskier.

There is no perfect solution — only tradeoffs to each approach.

Popular stablecoins

To understand how decisions about composition play out, let's work through some examples.

Tether is the world's largest stablecoin. At the time of writing, it has a $73 billion market cap and daily volume of $85 billion — an indication that real money is being held and exchanged in the form of Tether's USDT token.

Tether's success is, in part, due to its professed approach to collateralization. The project, operated by the owners of cryptocurrency exchange Bitfinex, originally claimed that every token of USDT was backed by a corresponding US dollar. In the years since its founding in 2014, that assertion has been called into serious question, with investigations revealing that Tether may collateralize as little as 2.9% with cash.

Still, at least in theory, Tether is a fairly centralized and collateralized project.

The second USD Coin (USDC) takes a similar approach. Created by payments business Circle, USDC is managed by a consortium that includes Coinbase and Bitmain. Like Tether, USDC claims that it is "always redeemable 1:1 for US dollars," though reserves may be held in other suitable assets. Again, it is centralized and collateralized.

MakerDAO uses a different model. Unlike Tether and USDC, the project's Dai stablecoin is collateralized by other cryptocurrencies, including Ethereum, USDC, Uniswap's token, and many others. There's more complexity to Maker's system, but for the purposes of this piece, we can summarize by noting that Dai is collateralized by on-chain assets and is decentralized.

Terra and Luna

In our conversation, Terra founder Do Kwon described his mission simply: to create "the most useful dollar possible."

Terra's attempt to do that begins with its series of stablecoins, pegged to different fiat currencies. TerraUSD (UST) tracks the US dollar, and TerraKRW (KRT) tracks the Korean won, for example. There are many other stablecoins offered, but all essentially function the same way. For the sake of simplicity, we'll refer to Terra's stablecoin as UST.

Unlike Tether, USDC, or Dai, UST is not collateralized by fiat or on-chain assets. Instead, its peg is maintained by Terra's other currency, Luna.

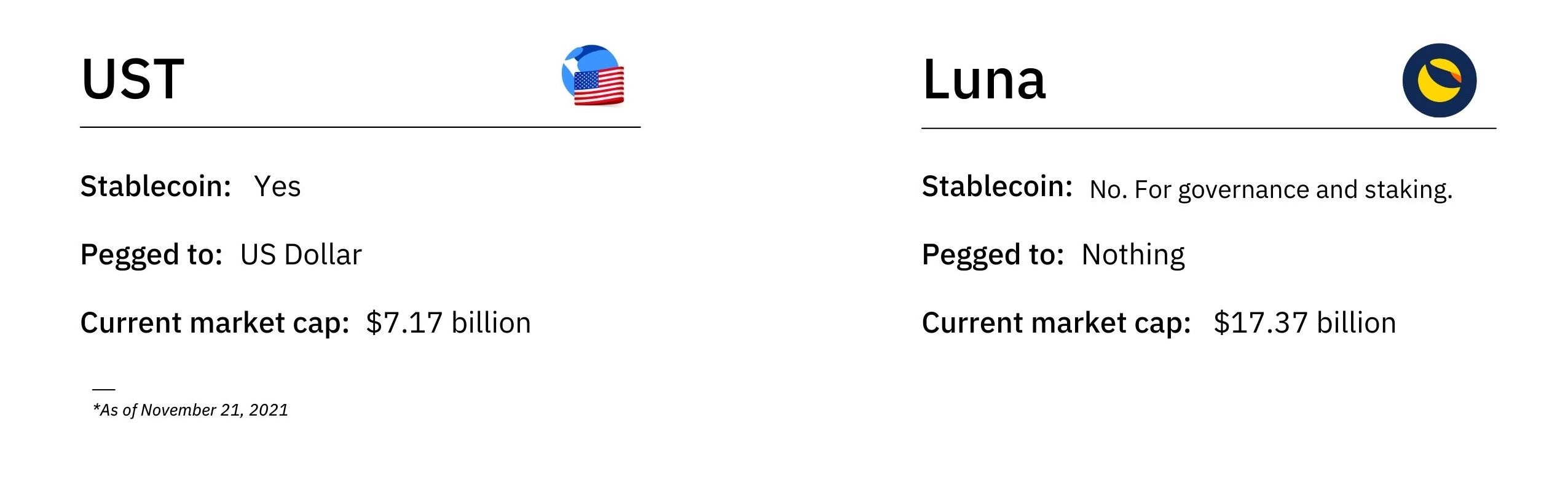

All of these different names might be a bit dizzying, but don't worry. It is not as complicated as you might think. For our purposes, we can say that Terra has two primary assets: UST (stablecoin) and Luna (governance and staking).

While UST is supposed to stay glued to a $1 value, Luna's price varies considerably. In the last 24 hours, at the time of writing, its price has appreciated 5%. To be explicit, Luna is not a stablecoin by design.

In addition to moving differently, Luna fundamentally represents very different functionality and assets within the Terra ecosystem. Specifically, it is a governance and staking token. That means that investors in Luna can weigh in on Terra's decisions. If they stake their Luna tokens with a network "validator" — essentially a node that helps Terra's system work — they will also get a percentage of the fees earned through processing activities.

Here's an example:

Imagine you're a Lunatic, one of Terra's super-fans.

You visit Great Fox's website, a clothing company based in Seoul. After some browsing, you find a sweater you like that costs $100. At checkout, you pay normally with your credit card. Little do you realize that Great Fox uses a Terra-affiliated entity to handle its payment processing! While that doesn't impact you as the buyer, the owners of Great Fox benefit from Terra's much faster settlement speed; instead of taking 5-14 days, it's handled in 6 seconds. Even better, the fees are lower. While incumbent processors take as much as 3%, Terra's cut is closer to 0.5%.

Now, where does that 0.5% or $0.50 go?

To Terra's 130 validators.

These sub-entities help Terra run and are rewarded for doing so. Their power comes from the amount of Luna that has been staked to them by token holders. These token holders choose to stake because it allows them to receive a share of rewards without having to do the work of a validator.

As a Lunatic, it only makes sense that you're staking your holdings. So, when that $0.50 processing fee makes its way to validators, a tiny fraction of it trickles down to you in the form of interest.

Hooray! You not only bought a dope sweater, you even made back a little money by buying it.

This function is what gives Luna a large portion of its value. It is an asset that produces revenue for holders. It also serves an imperative function in stabilizing UST, acting as a counterweight and pseudo-reserve.

For every 1 UST, $1 worth of Luna can be redeemed. As arbitrageurs take advantage of dislocations of this ratio, prices are brought back into check.

For example, when UST's price rises past the peg, Terra's algorithm "burns" or destroys Luna tokens to create more UST. As the supply of UST increases, its price falls, re-stabilizing. Because burning has reduced its supply, Luna prices increase when this occurs.

The same thing happens in reverse when UST dips below $1. In that case, Terra's system burns UST and creates Luna. Because the supply of UST diminishes, price increases; Luna's price falls.

Again, let's walk through how this works:

You decide you want to become a Lunatic. You buy some Luna tokens, as well as some UST. Through a miracle of timing, you manage to buy your UST when 1 token is worth exactly $1.00.

Now, a week later, you notice that the price of UST has changed. 1 UST is now worth $1.10. That's not ideal for stablecoin, but it presents an opportunity for you.

You remind yourself that every $1 worth of Luna can be exchanged for 1 UST. Since you hold Luna, you can take advantage of this price difference.

You decide to burn $10 worth of Luna for 10 UST. Because of the price of UST being at $1.10, that $10 stake is now worth $11. Hooray! You cash out into USD, locking in a nice 10% return.

Meanwhile, as more holders recognize the arbitrage opportunity and burn Luna for UST, the supply of UST increases until pricing returns to $1.

A month later, you look at your UST and see that the price has dropped. Now, 1 UST is worth just $0.90.

Again, you realize there's an opportunity. This time, you decide to buy $10 worth of UST. Because the price is depressed, you get more than 11 UST. Since Terra allows you to swap 1 UST for $1 worth of Luna, you decide to burn your holdings and create equivalent Luna.

You're left with $11 worth of Luna, having spent just $10. When other holders recognize the opportunity, they perform the same maneuver, burning UST and increasing the supply of Luna. Because of its reduced supply, UST recalibrates at $1.

There's a final kink to Terra's approach to stabilization. Every time Luna is burned to create UST, a fee is levied. As Kwon said in a recent tweet "[A]ll swap fees for burning Luna to Terra get paid out to Luna stakers spread out over 2 years." The result is that stakers are stably compensated for absorbing the network's volatility.

Notably, this fee is paid out in UST, creating a unique relationship. If the price of Luna drops, "staking returns go up linearly," per Kwon.

This is an elegant system, even if it takes a moment to wrap one's head around it. The methodology also has clear advantages. Because UST is not collateralized, it can scale indefinitely. You do not need to amass a Scrooge McDuck-sized vault of dollars to serve large populations. It is also decentralized.

As alluded to earlier, though, the algorithmic approach carries a real risk — something we'll discuss in-depth a little later. For now, let's look at how well it has worked.

Does it work?

From an adoption standpoint, there's no doubt that Terra's stablecoins have succeeded.

UST is the fourth most popular stablecoin in the world, behind only Tether, USDC, and Binance's product, BUSD. At the time of writing, its market cap sits at $6.8 billion, with $178 million processed in the last day. That's impressive, but still a huge distance from Tether and USDC. The former processed $85 billion over the same period.

Notably, UST is also the leading decentralized stablecoin — all of the others mentioned are far more centralized. UST recently surpassed Dai to capture that title.

More importantly, does UST function effectively as a stablecoin?

Mostly.

While there are certainly more advanced methods of assessing volatility, looking at the high and low of different projects gives us a rough indication of reliability.

By these measures, UST has been a considerably more volatile stablecoin. In the last year, the total distance between UST's high and low is 422% larger than Tether's, for example. We'll explain why that happened a little later, but for now, we can say that Terra's approach is working reasonably, though it has not maintained its peg as well as others.

We've spent a long time on this aspect of Terra's empire, but that's because it's the most important part. Everything Terra does is designed to make UST as robust as possible. As Shigeo, a well-known but pseudonymous Lunatic, put it, "The north star for the Terra ecosystem is to create more uses for UST."

Terra's first, best use case is Chai.

Chai: A practical application

Stability is necessary for a new currency to be viable as a method of payment, but it is not sufficient. Money is only useful so far as it can be spent — which means that it must be accepted by others.

Chai is Terra's solution for this problem.

As we mentioned earlier, Terra is unusual in the blockchain world in that it started with a practical problem and built tangible demand. It did so by partnering with e-commerce players to power its payments. Much of that was done through the Chai system, a spin-out from Terra's parent company.

Sensibly, Chai is run by Daniel Shin. Thanks to his e-commerce savvy and connections, he has succeeded in turning it into a payment processor of meaningful size and scale. It's worth noting that though intimately intertwined, Chai and Terra are formally separate entities. Though almost all of Terra's early usage came through Chai — and a large percentage still does — it is increasingly treated as an application built on top of the blockchain. As an emphasis of that point, Chai has raised its own venture funding, with $75 million coming from Softbank, HOF, and others.

Chai has both enterprise and consumer utility.

Businesses like TMON use the product's API to seamlessly accept remuneration across 20 different options, including debit cards, credit cards, and PayPal. Chai is popular with its clients because of its radically faster settlement process and lower fees. Critically, none of the businesses running on Chai need to interact with the blockchain or really understand it.

For consumers, Chai is a sort of neo-bank. They can connect to pre-existing bank accounts and pay for goods via a smooth, intuitive application. Again, there's no need for the average person on Chai to grasp what's going on behind the scenes.

What is happening is subtly magical. Terra is able to accept payment in any fiat currency, translate it into one of its stablecoins like UST, and pass it on to the vendor in their local currency.

How does that play out? Let's walk through it.

You live in Seoul and are a user of Chai. You enjoy its smooth UX and the perks you get.

During your lunch break, you decide to grab a coffee at Villa Volpe. Since it's a pretty swanky place, your latte costs ₩7,000. That's the equivalent of about $6.

You pay with that sum via Chai. To you, it looks like you've just paid in Korean won. In reality, your money is changed into 7,000 KRT — Terra's stablecoin pegged to the won. Simultaneously, ₩7,000 worth of Luna is burned, reducing supply and making Lunatics' holdings more valuable.

Via the blockchain, that KRT is seamlessly transferred to the merchant, where it is changed back into Korean won. Villa Volpe receives ₩7,000 without needing to know that your payment briefly morphed into a stablecoin.

Again we see the trait that is Terra's calling card: complexity abstracted into simplicity. In a matter of seconds, digital money hopscotches across the fiat-crypto divide and reaches its terminus.

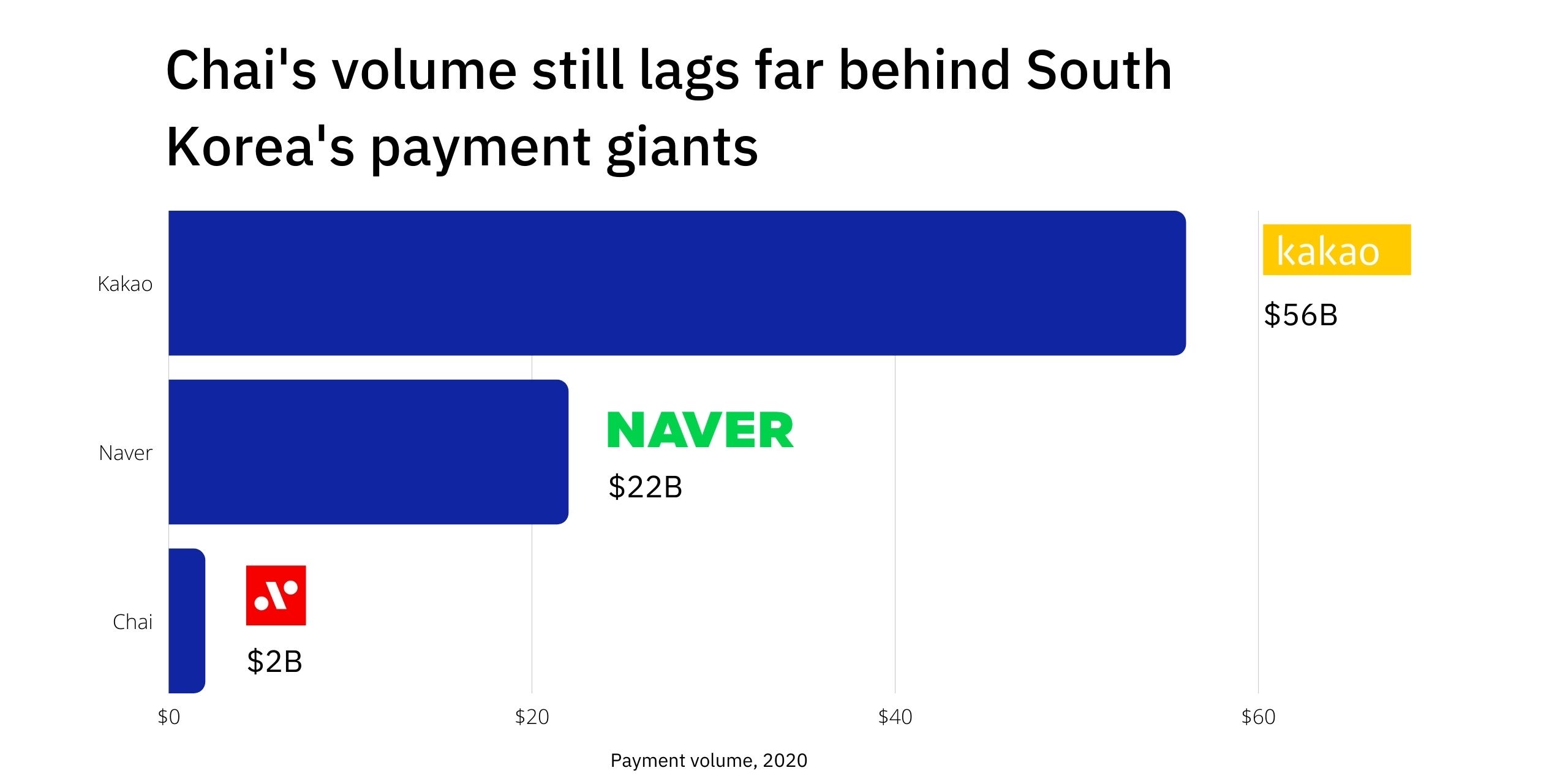

Chai's clear advantages have helped it gain meaningful traction. In 2020, the system processed $2 billion in volume, spread across 2.5 million users. More than 2,000 merchants use Chai, including Nike's Korean branches.

These are remarkable numbers. It is genuinely hard to think of other blockchain-based products that have accumulated millions of users who don't need to care about crypto to access the service. Sure, Metamask may boast more than 21 million accounts, but anyone that opens an Ethereum wallet is, in some respect, buying into the crypto movement. What's so striking about Chai is its ability to bring people into the web3 economy without them knowing it.

That doesn't mean there isn't a long way to go. Though 2.5 million users is nothing to sniff at — and it has certainly increased over the past 11 months — it lags many of Korea's web2 offerings. Market leader Kakao hit 35 million users in 2020, processing more than $56 billion. Second-in-line, Naver managed 28 million with $22 billion processed. Chai is an order of magnitude or more behind both.

In time, it may not matter. After all, Chai is not the only payment system built on Terra. Not long after the company began operations in Korea, it partnered with a Mongolian company, memeChat, to achieve something similar. Through the collaboration, taxi drivers in the country are able to receive payment much faster via memeChat, by dint of its financial operations running on Terra.

Don't miss our next briefing. Join 53,000 readers and get powerful business analysis delivered straight to your inbox each Sunday.

Terraform Labs: Seeding the ecosystem

Kwon and Shin's creations sit beneath a parent company: Terraform Labs. It is responsible for creating Terra's blockchain, fleet of stablecoins like UST, and payments system Chai. This is the entity that raised venture funding in 2018 and has continued to do so. Earlier this year, Terraform raised $25 million from Galaxy Digital, and others.

Terraform plays a vital role in the success of Terra's products. Not only does it provide financing, but it actively builds solutions it believes the ecosystem needs. Chai is an example, but there are several others that have emerged over the years.

Before diving into them, it's worth noting how unusual this approach is. Base layer blockchains like Terra usually prefer to allow an ecosystem to emerge organically rather than deliberately building one. In that respect, Terra seems to build products in which it can act as its own first, best customer. Those tactics bring to mind a web2 giant: Amazon.

As articulated by Ben Thompson, many of the extensions to Bezos's empire can be viewed through this lens. AWS, fulfillment centers, and delivery fleets all fit this heuristic. Amazon used these products itself and could subsequently open them up to others.

Terraform's creations share this logic. While the Terra blockchain benefits first from products built leveraging its technologies and currencies, others will be able to take these "primitives" and bring them forward.

To get a sense of how this works, we'll walk through some of Terraform's most crucial creations: Terra Station, Anchor, and Mirror.

Terra Station

Money needs a place to be stored — Station is Terra's solution. Though less revolutionary than some of Terraform's other inventions, it fulfills a vital need.

Via Station, users can hold their Luna, swap it for UST or other Terra stablecoins, delegate their stake to a validator, and participate in governance. It is, in essence, a simple hub to manage one's relationship with the Terra ecosystem. Jason Hitchcock, a partner of To The Moon Capital, shared how striking it was to use Station, noting that "the transactions were instant and (nearly) free. It felt like using a normal app."

For more complex products to work, the basics need to be covered. Station helps that happen.

Anchor

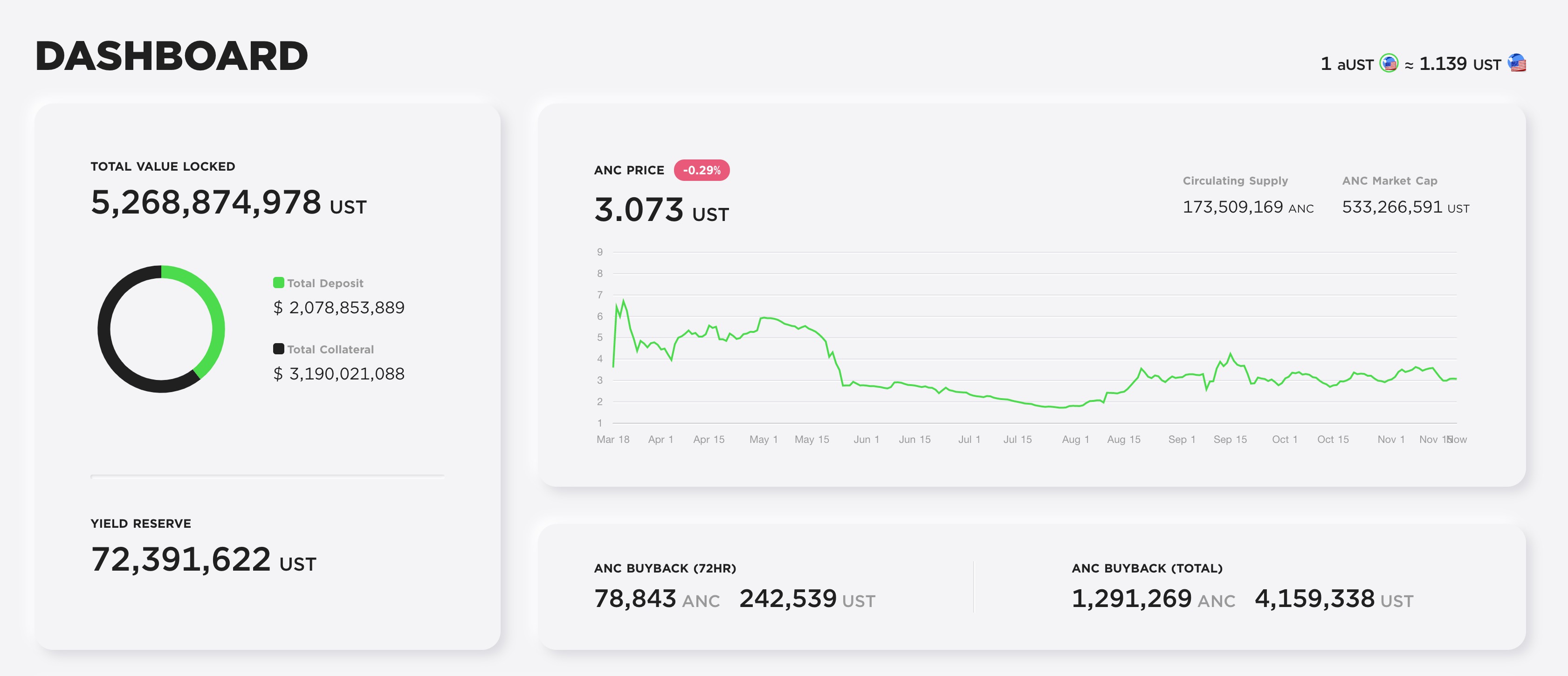

In March of this year, Terra released the Anchor Protocol, its answer to savings.

Like Terra's other products, it is designed to be simple to use and geared towards mass adoption. By staking stablecoins on Anchor, users can earn interest of nearly 20% — their holdings are loaned to borrowers across other proof-of-stake blockchains. While this isn't as high as some other yield-generating platforms, it's certainly a great deal more than the national average of 0.05%, and it's stable. That's quite novel in the world of DeFi — usually, interest can fluctuate wildly, encouraging users to hop between platforms in search of the best returns. By providing this reliability, Terra makes Anchor feel like a safe, long-term custodian.

That's helped by a user-friendly interface that makes it easy to earn, borrow, or even ensure a position.

So far, that value proposition has resonated. In the nine months since its launch, Anchor has reached $5.1 billion in Total Value Locked (TVL), a measure of the assets on the platform. That makes it the eighth largest player in DeFi by that metric, beating out Yearn Finance and Sushi.

Across the Terra ecosystem, nearly $10 billion is locked.

Critically, Anchor is not just a consumer-facing product — it serves other builders, too. With Anchor's open-source SDK, other crypto projects can easily integrate "Savings-as-a-Service" into their product. With 10 lines of code, a new crypto wallet developer could allow its user base to make the same 20% return without needing to interact with Terra directly.

Pylon is an example of what can be built by relying on Anchor. Instead of paying for a product or service, Pylon allows you to simply delegate your "stake" to another party that profits by earning your Anchor yield. You can choose to withdraw your principal, meaning the only capital you have "spent" is in the form of interest.

You can imagine how this might work in seeding a startup. Rather than "spending" 1 million UST backing an early-stage company, you could stake that amount, giving the team access to 200,000 UST in interest per year. While you could still receive an equity share, you'd have the ability to withdraw your principal.

Despite its potential, Pylon's offering has yet to really catch on. The solution's native tokens have plummeted, meaning that early adopters have received scant reward for their early faith. But Dave Balter, CEO of crypto analytics platform, Flipside, believes in its promise:

I think Pylon is a very exciting project because of the scale of its reach and ambition, and because its team is talented and passionate, and building something that solves an actual customer pain (no one likes paying subscription fees, even for services they like!)...Sometimes you need to get canceled in crypto to make it...Building something new requires taking some lumps.

Mirror

Terra's answer to Robinhood comes in the form of Mirror. On the platform, users can trade synthetic assets, a capacity reminiscent of FTX.

Theoretically, those assets could be almost anything: stocks, ETFs, commodities, and so on. In practice, it's focused on the first two of those, offering synthetic versions of Apple, Tesla, Alibaba, the iShares Silver Trust, Invesco QQQ, and others.

Compared to traditional exchanges, Mirror has a few clear advantages: it is open 24/7, there are no national boundaries meaning any equity is theoretically available, fractionalization is simpler, and transactions are faster. Users quickly flocked to the platform after launching this year, with 2,000 accounts registered daily.

The major downside is that authorities aren't exactly thrilled by it. While Kwon was on stage at Messari's Mainnet Conference, he was served papers by the SEC. One of the regulatory body's main areas of interest was Mirror. Kwon responded with a counter-suit — a strong statement, though perhaps not one that suggests prompt reconciliation.

For now, Mirror is still a clear star in the Terra constellation. As with Anchor, new products are being built using it as a primitive. One example is Spar, an asset management platform that relies on the trading platform.

Prism

Though yet to go live, Prism is arguably Terraform's most innovative product. Through the new protocol, users will be able to "refract" assets into a principal component and a yield component. For example, Luna could be split into pLuna, representing the principal, and yLuna, marking the yield.

Splitting assets enables new use cases. For example, someone in need of liquidity could sell the future yield of their asset, or yLuna. Equally, someone could decide they want a yield-generating asset with no underlying risk of liquidation, and purchase pLuna. In effect, Prism creates tooling for interest rate swaps.

It's another example of how Terra succeeds in turning financial instruments into "Lego blocks," making different products composable. Shigeo explained how this applies to Prism:

Terra is creating a "Legoland" of blocks of money that can be used together to create anything that can be imagined. Prism Protocol, for instance, is going to take LUNA and split it into yLUNA and pLUNA. These two pieces of LUNA will have a principle and yield aspect to it.

Another protocol might want to just take the yLUNA and create a token that represents 12 months of yield from yLUNA or 12yLUNA that can be sold for 12x yLUNA. These are the kinds of things possible within the Terra ecosystem.

Ozone

The final worthy entrant is Ozone, an insurance product for the Terra ecosystem. Though it has yet to go live, it represents a consequential piece of the puzzle.

Ozone will operate as a marketplace in which participants can buy and sell coverage. In particular, these insurance products are designed to cover "technical failure risks in the Terra DeFi ecosystem," according to Kwon. Essentially, if for whatever reason an error occurs such that a user could not access their Luna or UST, Ozone would compensate for potential losses.

It's an extremely clever addition, particularly as Terra's ecosystem springs into greater life. As long as you're covered by Ozone, there's little risk in experimenting with a new Terra dApp. Even if it fails, your holdings should still be secured. The upshot is that Ozone's presence reduces the effective cost of experimentation, making it easier to build on Terra and attract users.

One of Ozone's first big customers is early Terra investor Michael Arrington. His Arrington Anchor Fund will deploy institutional capital into the Anchor Protocol, withholdings secured by Ozone. LPs get the chance to receive 20% interest with an extra layer of protection.

Earlier this month, Terra announced that Ozone would be managed by an external party. Risk Harbor, a provider of insurance for DeFi protocols, is assuming control. In a press release, Kwon noted:

We're thrilled for the Terra community to have Risk Harbor take the reins of Ozone and pioneer a capital-efficient and decentralized risk management marketplace for the Terra ecosystem at large.

This movie tells us a great deal about how Terraform wants to operate. Rather than grasping for more and more power, it seeks to decentralize itself, to dissipate as the ecosystem takes over. That is happening at an ever-faster rate.

Beyond Terraform: A thousand flowers

"The speed in which new projects are launching in the Terra ecosystem is staggering."

That opinion, shared by Shigeo, is a popular one. For many of the project's biggest fans, Terra is on the cusp of a big breakout.

That seems to be in large part thanks to the recent release of "Columbus-5," an upgrade to Terra's core system. "Col-5" simplifies the relationship between UST and Luna, lays the groundwork for Ozone's impending launch, and makes it easier for Terra products like UST to operate across different blockchains. As Jason Hithcock noted, "The Columbus-5 upgrade was a major dependency for 160+ protocols that are in the midst of launching."

In addition to these technical upgrades, Terra is also deploying capital to energize its ecosystem. In July, the team announced it had raised $150 million to deploy into projects being built on top of Terra. That funding comes from familiar names in the Terra ecosystem, including Arrington Capital, Galaxy Digital, and Hashed.

Let's explore some of the incoming cohort's most promising players.

Mars

Developed as part of a joint venture between Delphi Labs, IDEO CoLab, Terraform and others, Mars Protocol is bringing new financial services to Terra. Specifically, Mars will operate as an "interchain lending platform," as described by Jeff Kuan, one of Terra's employees.

Managed by the "Martian Council," Mars will offer new ways for lenders to receive interest on staked funds and open up assets to borrowers, both collateralized and uncollateralized. One of the Mars teams' major innovations is the introduction of "reactive interest rates," meaning yields will respond to market conditions.

Lunatic Papi shared his bull thesis for Mars:

I'm insanely bullish on Mars…[it] will be the first general-purpose lending platform on Terra. Mars will enable leveraged long LP farming, bringing leveraged liquidity into the ecosystem while at the same time creating very attractive yield farming opportunities.

In time, Mars intends to become a fully-featured, decentralized bank.

Astroport

The same group is also responsible for Astroport, a decentralized exchange built on Terra. As the ecosystem has grown, the need for an endemic "Automated Market Maker" (AMM) has expanded with it. In that respect, Astroport enters as a kind of Terra-native Sushi or Uniswap. Its arrival could be significant, according to Flood Capital, a Twitter account associated with Delphi:

Astroport is definitely the most interesting project that I am aware of so far. You can think of Astroport as a mix between Uniswap and Curve. It will provide typical AMM pools alongside stable swap pools and then hopefully concentrated liquidity in the future. What makes Astroport really interesting for Terra is the fact that the main pairs will be based against UST. Meaning a large portion of the capital Astroport collects will increase UST supply and the Luna burn.

In order to have Terra dapps really take off, you need a DEX, so I think this will be one of the cornerstones for Terra and a big moment in its history.

As Flood explains, Astroport not only brings new functionality to the Terra ecosystem it will increase demand for stablecoins like UST.

Levana

Once again, Jeff Kuan had my favorite description of this addition to the Terra ecosystem:

Levana: a project built on top of Mars providing leverage to those wanting to ape harder.

Essentially, Levana uses Mars to bring 2x leverage to Terra. Instead of just buying Luna, for example, users can purchase 2x Luna, which produces double the returns should the token increase in value.

Over time, Levana intends to add leverage to all manner of assets, including index tokens. As with Mars and Astroport, it is being incubated by Delphi Digital. With 50% of tokens allocated to the community and treasury, Levana seeks to operate as a true DAO.

Neobanks

Terra has always been unusually cognizant of building products that can reach widespread adoption. Both Chai and the partnership with memeChat were minded toward this goal. As we mentioned, though, expanding real-world usage of UST and other Terra stablecoins does not solely rest on these products. Rather, other products are coming to market that leverage Terra's technology as a means to an end. This is particularly evident in the neobank space.

Founded in 2021, Alice Finance may be the best known. The US-based company has raised $2 million in financing to create a consumer-friendly bank that operates as something between Venmo and Anchor. You can make peer-to-peer payments seamlessly but also earn 20% interest on your holdings in the app.

Though operating under the radar, Seashell seems to be taking a similar tact. Though information is limited, the company professes to offer 10% APY and reportedly pulls its yields from Anchor. According to one source, the company was funded by venture firms Khosla and Kindred.

As ecosystem lead, 0xwagmi explained, Terra expects many more players like this to crop up over time:

[W]e expect a lot more neobanks like Alice to pop up, in every geography, and for them to be as big if not bigger than neobanks in that geography. What you saw happen with neobanks (many unicorns built across many Geos) will happen in our ecosystem. Terra will play the role of, say, a Plaid/Stripe/Crossriver in that world.

Kado is another company helping build on-off-ramps to the Terra ecosystem. Less of a neobank, Kado focuses on improving payments, making it simple to spend stablecoins across the internet. The company's website also notes that it's working on a savings product.

Gaming and NFTs

[W]e see gaming as a very early trend in the Terra ecosystem. Gamers are going to want to earn in a stable pegged cryptocurrency like UST and we expect DAOs and gaming guilds to get very big in the ecosystem.

That prognosis came from 0xwagmi, the ecosystem lead mentioned earlier. Terra does seem to be making waves in gaming and, by association, NFTs.

Hashed, one of Terra's earliest investors, is expected to play a large role here. The firm's creative studio, UNOPND, is reportedly building five different games for the Terra ecosystem, including some that are "play to earn."

Other game publishers are also coming to Terra. This past week, Kwon announced that Gameville would be bringing titles like Summoners War to the ecosystem.

As Terra's official Twitter account went on to note, this will increase demand for related NFT sales.

That should be a boon to Terra-native marketplace, Random Earth. Though still in its early days, Random Earth operates as a sort of OpenSea, focused on the Terra ecosystem. In our discussion, the project's founder, Stargazer, mentioned why they'd chosen to build on Terra:

It felt like Terra was gaining a lot of TVL in DeFi. And after trying various protocols as an end-user, it seemed like an ecosystem with a lot of traction, but also a lot of greenfield for building. My co-founders and I started ideating, and we felt there was an opportunity to build our own product, so we did.

Stargazer's decision looks well-timed, not least because it appears to be involved in Terra's joint-venture with South-Korean behemoth, Naver. The latter's "metaverse platform," Zepeto," is creating a game for the Terra ecosystem, which was recently featured on Random Earth's YouTube channel.

The portal to South Korea's version of the metaverse may live in the Terra ecosystem.

Others

There are dozens of other intriguing projects being built with Terra. Without spending too much more time on this topic, it's worth knowing about a few more of them:

- White Whale. This is a particularly exciting one. White Whale gives users a way to arbitrage dislocations in UST pricing automatically. It also intends to offer other automated trading strategies. By making this kind of activity accessible, White Whale can bring more participants into Terra's ecosystem and effectively "decentralize the enforcement of the peg."

- Angel Protocol. "Give once, and give forever" is the premise of Angel. Leveraging Anchor's yields, Angel makes it easy for charities to set up endowments with high returns. Donated funds can continue to produce meaningful yields indefinitely.

- Nexus. This protocol looks to operate advanced yield strategies on Mirror and Anchor. Critically, it's designed to eliminate the risk of principal liquidation. Jason Hitchcock highlighted its potential to increase demand for UST and drive higher returns.

- Nebula. As its name implies, Nebula is bringing "clusters" of assets to Terra. Operating like ETFs, users will be able to buy into clusters that represent certain themes.

- Sigma. Leveraging order book technology created by Random Earth, Sigma is bringing options trading to Terra.

- Orion Money. Through Orion, users can access 20% APY on any stablecoin. That means you could deposit Tether, USDC, or UST onto the platform and receive the same returns. Orion also offers ways to protect your principal investment through insurance products.

- Suberra. Another one of Delphi's projects, Suberra, makes it easy for businesses to accept recurring payments in stablecoins. For example, with Suberra, The Generalist could accept annual subscriptions in UST.

- Valkyrie. A potential "win-win for digital marketers and protocol funding campaigns," according to Papi, Valkyrie brings social referrals to the blockchain. Through the protocol, referrers are rewarded for both direct and indirect conversions.

If there's one downside to all this activity, it may be that it's spreading capital too thinly. Shigeo noted this, saying:

I think the opportunities to invest in different protocols may become problematic in the short term because of the amount of protocols launching at the same time. Capital within the ecosystem is limited so the more capital is diluted between protocols, the more ineffective it becomes.

Terra's Ecosystem Fund should help ensure capital is directed toward the highest-impact projects. It will hope that consumers follow suit.

Understanding Terra: YC or Singapore?

We now have a good sense of Terra as a product and platform. We've outlined how Terra seeks to make money better and what functionality its innovations unlock.

But how should we think of what Terra is doing? What is the right way to frame its work?

It's vital to walk through a machine's gears if you want to understand how it works, but you also need to grasp its purpose. To return to our watchmaking analogy, the mechanisms at play do not only provoke a tiny hand to move around a circle; the more important thing is that they keep time.

Let's synthesize what we know about Terra and move a layer up to improve our grasp.

Money Legos

The first way to understand Terra is as a purveyor of "Money Legos."

As Shigeo and others mentioned, Terra is fundamentally creating a composable financial infrastructure. UST is the "medium of exchange" block, Anchor is the "savings" block, Mirror is the "synthetic investing" block, Prism is the "interest rate derivatives" block, and Ozone is the "insurance" block.

Others can add blocks of their own to Terra's set or use the existing pieces to create something new. Alice, for example, takes the UST and Anchor blocks out of the box and builds a neobank; Angel reaches for the same pairing but attaches new features to create a charitable endowment; Spar adds the Mirror block to bolster its asset management solution.

This lens helps us understand the Terra team's approach to developing foundational products in-house— you cannot build anything if you do not have at least a few different types of blocks to start with. By seeding the ecosystem with these primitives, Terra has created conditions in which it is much easier for others to build products of their own.

Y Combinator

Another popular description of Terra is as crypto's version of Y Combinator (YC). The famed incubator has served a leading role in the growth of the startup ecosystem, seeding some of the most impactful businesses of the last decade and a half.

Some believe Terra could serve a similar role for web3. The $150 million Ecosystem Fund is a step in that direction, and many early projects show promise, as mentioned. There is a long way to go before Terra can reasonably claim to have fulfilled an equivalent on-chain as YC managed for startups, but this lens captures something of the bottom-up ethos of Terra.

When asked where they hoped Terra would be in 1, 5, and 10 years time, 0xwagmi said:

[M]ost importantly, we will see a wave of founders in the ecosystem (kind of like how YC was just [Paul Graham]...100s of founders now support YC and the growth of the YC nation-state). We are just in the beginning stages of that.

Nation-State

During our discussion, Do Kwon returned again and again to Singapore. In particular, he frequently referenced Lee Kuan Yew (LKY), founder of the city-state, describing him as an "idol."

What Kwon seemed to admire most about LKY was his efficacy in setting the incentives for Singapore to flourish. He noted that the state did not naturally lend itself to becoming a business hub: it had natural enemies, a torrid, tropical climate, and little tourism traffic. To compensate, LKY forged favorable conditions, including a strong, business-friendly rule of law, a fair bureaucracy, and a favorable tax structure.

"One of the things that Singapore did really well is understand that Singapore is a platform," Kwon said. "Empires don't think of how to attract users."

Kwon thinks of Terra similarly. Though Terra is keen to facilitate a grassroots revolution, its early "policies" were, by necessity, top-down. The way the project speaks of its currency mechanics, market modules, and treasury is often in the language of nations. In many cases, Terra seems to serve a similar purpose to a central bank, stimulating progress in the manner it considers most advantageous.

(Kwon would be keen to point out that Terra does so without political impetus. In discussing how governments set savings rates, he remarked that "not only is that [political rate-setting] a massive bug for the saving's feature of the dollar, it's immoral.")

Moreover, Kwon recognizes the need to create ideal conditions to attract users and facilitate progress.

Part of that is the Terra team's commitment to helping any project built on the system. Kwon recalled how he previously announced an initiative that allowed anyone building on Terra to call him night or day for free advice.

Another element is Terra's own mission to continue improving its platform at a rapid rate. "We always make it a rule that we're going to be the fastest people to ship in the entire industry," Kwon said.

It's clear that, at the very least, Terra thinks of itself as a modern state. That framing seems to inform its priorities, culture, and the road ahead.

Death spiral: Risks and regulation

Terra could fail.

As with every crypto project, it operates at the nexus of technological complexity, behavioral caprice, and regulatory uncertainty. Still, even while the sector carries these endemic risks, Terra feels like a special case, simultaneously particularly vulnerable and especially robust.

Let us embark on a bear case.

How algorithmic stablecoins can fail

In late May of this year, the crypto market went into a rapid meltdown. On the 19th of that month, Bitcoin dropped 30%, with the wider market falling alongside it. In the following days, Luna took a beating, dropping to a price of $4.10. That represented a 75% decline from where it had traded a week earlier.

As investors lost faith in Luna, demand for UST also retracted. This caused UST's price to drop below its $1 peg, prompting holders to swap their UST for Luna. By doing so, UST holders effectively minted more Luna at a time when demand for it was drying up. This caused pricing to fall further, exacerbating a vicious cycle. Many feared a full-on collapse.

This risk, often referred to as a "death spiral," is a common one for algorithmic stablecoins. Indeed, some academics have suggested they are "built to fail." They are not formally backed by another asset but are implicitly guaranteed by a secondary token. UST is not collateralized by Luna, but there's certainly a sense that the latter bolsters the former (and visa-versa). As faith disappears for the pseudo-reserve token, a bank-run effect can ensue.

This dynamic has killed other projects. In June, a project called Titan was sucked into the death spiral. Like Terra, Titan operated with an algorithmic, two-token system. Its Iron token served as a stablecoin that was backed by 75% USDC and 25% of Titan's own token. When Titan's price started to drop, Iron's did as well. Holders of Iron then recognized an arbitrage opportunity, trading a token worth $0.90 for $0.75 worth of USDC and $0.25 worth of Titan. This process minted more Titan, worsening the effect. Titan eventually leveled out at close to $0 in value.

Though they are both algorithmic stablecoins, comparing Titan to Terra feels unfair. The latter has much more robust stabilizing features, an elite founding team, and one of the most engaged communities in crypto. It has built products used by millions, both in and out of the crypto milieu.

All of those helped Terra survive the May scare. According to CoinGecko, UST's lowest ebb was $0.96, though other sources suggest it dropped further. Whatever the case, UST succeeded in regaining its peg, demonstrating that Terra's system was capable of weathering a steep decline. The Luna slide stopped, and Terra's algorithm righted the ship.

There will be further tests, of course. For Kwon, UST's greatest protection is the demand it has built up. Thanks to Chai, memeChat, Anchor, Mirror, and the many other products that leverage it, UST has a solid user base that is growing quickly. Even if Luna were to decline, that mature demand for UST would not evaporate.

Luke Saunders, CTO of Delphi Digital, summarized this point, "[T]he utility built up around UST has a great stabilizing effect which [other stablecoins] lacked."

Though Kwon is dismissive of those that raise fears of a death spiral (favorite terms include "idiots" or "cockroaches"), he does seem to be taking steps to add further braces to UST. In a recent tweet, he said reserve assets were coming to Terra:

Ultimately, many may feel as if this risk is priced into Terra. Were it perfectly secure, Luna might be worth several orders of magnitude more.

Regulatory crackdowns

Kwon's bolshy demeanor is not solely reserved for Terra's non-believers. He seems to save a healthy portion for the financial authorities as well. As Baek Kim noted, "He likes to put his finger up to the regulators."

That was best illustrated by Kwon's decision to sue the SEC in response to the papers he received at the Mainnet conference. That counterpunch aims to free Kwon from complying with the entity's subpoena.

From the outside, at least, it seems like a move true to Kwon's character but perhaps unwise. In our conversation, Terra's creator was sanguine about the possibility of legal recompense. "I'm sure we could be punished...In the current regulatory environment, that probably will happen."

He continued:

I was in the army, so if I go to jail, it's no big deal...If they put me in a courtroom, I wouldn't make a change to the Terra network. That would violate my moral code.

If you're trying to disrupt incumbent systems to this degree...there are going to be regulatory challenges. These are challenges that the stand-bearers will have to deal with.

It's hard not to hear this stance without two clear reactions:

- This is extremely badass.

- Please staff an exceptional regulatory team.

Though spiritually antithetical to Terra's ultra-decentralization, Coinbase should be a model here. The crypto exchange has forged true regulatory moats by building a team of experts capable of bringing finesse to its disruption.

In many respects, Terra should be equipped to benefit from regulatory action. Saunders explained this:

It seems likely that at some point, centralized issuers of USD pegged or backed stables will become subject to some regulation which forces them to only allow transfers in a compliant fashion, which decentralized protocols will be incompatible with. A decentralized stablecoin however would be much harder for regulators to impose compliance requirements and so a better fit for DeFi.

Saunders added that UST's ability to flip USDC and Tether and become the largest stablecoin is in large part dependent on what action regulators take against those centralized competitors.

Perhaps this, along with his status as a South Korean national, is why Kwon feels empowered to give the SEC the bird. But even if Terra cannot be truly censored thanks to its decentralization, it can certainly be disrupted.

The most damaging way that might happen is by having mainstream access cut off. If users cannot buy or sell Terra, its ability to mainstream crypto may be significantly hampered. Presumably, a move of this type would also stall businesses like Alice and Seashell.

Given the team's connections, it seems unlikely that even in such a scenario, Terra would be curbed in South Korea. This, too, gives a degree of protection, even if the worst were to occur.

Kwon has undoubtedly gamed these scenarios out. Lunatics will hope that when it comes to regulatory matters, his admirable devotion is married with tact.

Lagging throughput

As Terra grows, there's a risk that it slows down. This may become a particular worry given Terra's mainstream ambitions and existing broad usage. With many new projects about to launch, such concerns could rise to the fore.

Terra seems to be on top of this potential risk. For one thing, Terra is built using Cosmos' proof of stake mechanism, called Tendermint. This allows for 10,000 transactions per second — a figure Terra is unlikely to hit in the near term. Kwon has previously said Terra processes up to 1,000 transactions per second at the moment.

Secondly, Terra is devoting real capital to improvements. "Project Dawn" announced the team's intention to spend $1 billion or more on upgrading infrastructure through hires, partnerships, and other initiatives. 0xwagmi noted:

[W]e are making massive investments in scaling the Terra chain and infrastructure to support massive scale and usage. This is a multi-year effort.

Saunders mentioned that he had looked closely at the issue, and left with his fears abated:

Eventually, given the rate of growth, the Terra chain will become congested, so one of the biggest risks was always that Terra wouldn't scale. That said, I've talked to Do Kwon, Chorus one, and some Tendermint devs recently, and I'm actually pretty satisfied that improvements can be made to allow Layer 1 throughput increases.

Limited mindshare

Terra feels as if it does not attract as much oxygen as it deserves. This is, after all, the 13th largest crypto project in the world by market capitalization. It outstrips Uniswap, Axie Infinity, Stellar, Aave, Filecoin, Helium, Sushi, and many others that may sound more familiar. It has real tangible, mainstream usage, a charismatic leader, and a flurry of products.

Why is it not more discussed?

In part, that's a consequence of its origins. Terra has historically focused on the Asian market, meaning that those of us in the West are less familiar with its reach and influence. In time, as Terra spreads — one of its largest hubs is now in Poland — that should change.

The other reason is that Terra does no marketing. None. Instead, it hopes to build a community through the value it creates. While focusing on that draw certainly seems like the right move, it's reasonable to wonder whether Terra could be less dogmatic in its approach to spreading the word.

At one juncture in our interview, 0xwagmi remarked, "I think we need more great talent in the ecosystem."

Dave Balter made a related comment, saying, "There's a shortage of Rust developers, which might slow down how fast the ecosystem can expand."

Though not a panacea, publicity can succeed in attracting developers and other valuable contributors. Though calling it a "risk" feels hyperbolic, Terra should not close itself off to marketing if it sees an opportunity to meaningfully pull forward remarkable talent, particularly when supply is scarce. The compounding impact would more than offset any expense.

Crypto Steve Jobs: Terra's unique strengths

We have already highlighted much of what makes Terra special and interesting. But there are a few other topics worth addressing that contribute to the Terra bull case. Perhaps the most important is Kwon himself.

Do Kwon

Crypto tends to attract ideologues. Some of those that adhere to the gospel of decentralization can come across as both uncompromising and unthinking, incapable of considering alternative vantages.

Do Kwon is not one of these people. While he has the devotion of a true believer and seems to view most governments as fundamentally nefarious, he boasts remarkable intellect, poise, and foresight. He also seems to be a preternaturally gifted leader, able to galvanize Terra's contributors and articulate the project's vision magnetically. That skill does not come without cost — Kwon appears to be a highly intense individual with exacting standards that brought to mind one of the great inventors of the last hundred years. Per 0xwagmi:

I did VC before this as well and know my share of Unicorn founders. Do Kwon is an absolute force of nature, I have not quite seen anything like him. In many ways, I see him as a Steve Jobs figure of crypto, he demands an incredible amount from his (small) team.

Perhaps Do's time in the army has contributed to management described as martial. Again, from 0xwagmi:

Do's leadership style is very much a General...He is also very product-focused, he is a builder at heart. You can tell with his engagement in day-to-day product discussions.

While there are certainly plenty of downsides to ruling with too firm a grip, Kwon seems to fall on the right side of the line. He is the heartbeat of Terra, and his ferocious motivation should be seen as a great addition. Moreover, while he may be rather relentless in driving Terra forward, he takes a softer approach with the community, welcoming newcomers and helping them get off the ground.

Lastly, it's worth noting that Kwon is clearly driven by more than money. In our conversation, he said, "We don't intend to walk out of this journey being billionaires."

Community

More than once, sources I spoke with identified Terra's community as one of its key strengths. From Stargazer:

Terra has a very engaged community. That's probably the most important thing. Lunatics seem to have a very cohesive culture compared to other ecosystems. I think this community traction is gonna be key to its success.

Kwon undoubtedly plays a key role. Stargazer highlighted this point, too:

I believe much of this flows from Do Kwon himself. He's such an open, welcoming, thoughtful, and engaging leader - he sets the tone for the rest of the ecosystem, which is focused on embracing others and supporting everyone's builds.

Part of the reason the community is strong seems to be because it is given real trust. At the beginning of this year, Terra announced "Project Surge," an initiative aimed at growing the ecosystem. Specifically, Surge incentivized community members to spread Terra to different chains. Members were encouraged to join the long tail of DeFi projects and protocols, learn about them, and then propose Terra's inclusion. Drives like this one are an indication of how Terra activates its community and the meaningful work it is given.

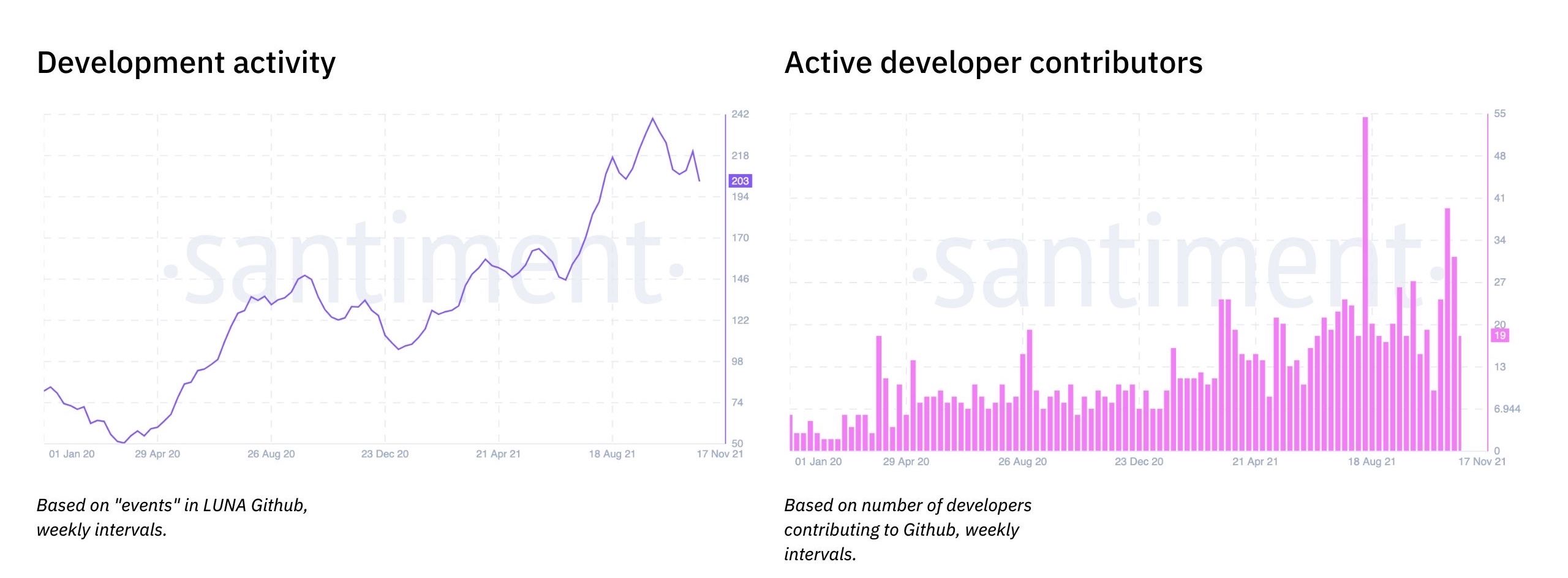

Perhaps consequently, Terra's community seems to have grown. Looking at the number of individual contributors and code commits over the past year, we can see meaningful growth in both metrics:

Though the trend is impressive, there is still room for improvement. Solana boasts 7.5x the number of code commits, for example.

Built for a multichain future

Though Terra operates its own "Layer 1" infrastructure, the project can thrive even if other chains supersede it. Indeed, Terra is in many ways built for a future in which multiple chains exist and receive meaningful traffic.

That's because Terra's most important product is not its core infrastructure but its stablecoins. UST's adoption is Terra's priority, and the team actively wants it to spread to other chains. Terra team member, 0xwagmi, explained this:

Yes, we are a Layer 1 that supports a native experience, but also any protocol/project on any chain can use UST. We expect most UST to be bridged to other chains and platforms in the long term; we are leaning into the multichain future in many ways. Just like teams will have Android and iOS teams, we expect teams to build across platforms in the future. To start that relationship, we expect teams to use UST, see a great audience of UST users, and then build Terra native protocols.

To facilitate this behavior, Terra is devoting resources to building bridges between chains.

Perhaps more than any other project, Terra is positioned to take crypto mainstream. To bring its particular benefits to those that have no interest in understanding what is happening under the hood. With Chai, it has already proven its ability to do so; its newer products open a dizzying set of possibilities, an infinite, expanding set of ways to arrange the platform's "money legos."

Where will that lead us? Who knows.

But the fact that it is not inconceivable that many, many millions could run their financial lives through Terra is a sign that such a world is closer than we believe. We may, in time, pay our local store in UST, save via Anchor, and trade on Mirror — all the while not knowing what makes it tick. Isn't it pretty to think so?

Stay one step ahead of the most important trends shaping the future. Our work is designed to help you think better and capitalize on change.

----

*See important disclosures

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Join over 55,000 curious minds.

Join 100,000+ readers and get powerful business analysis delivered straight to your inbox.

No spam. No noise. Unsubscribe any time.

.jpg)